Bitcoin started as an experiment in digital money back in 2008. Today, it’s worth around $2 trillion – roughly the same market cap as Amazon. But unlike Amazon, Bitcoin has no CEO, no employees, and nothing to sell. So why do investors hold it in their portfolios? Here are three potential reasons.

Reason 1: Scarcity and the digital gold thesis

Bitcoin is the only asset in the world with a limited and fixed supply. That’s different from gold, which is limited – but not fixed. We don’t know exactly how much gold is left in the earth’s crust. But we do know there will only ever be 21 million bitcoins. That number is mathematically programmed into its code. It can’t be changed – not by central banks, politicians, or even developers.

Bitcoin is fundamentally different from fiat currencies like the US dollar, euro, or yen. Governments can (and regularly do) expand and dilute the money supply. That creates more units of currency chasing the same amount of goods, which can cause inflation by making money worth less.

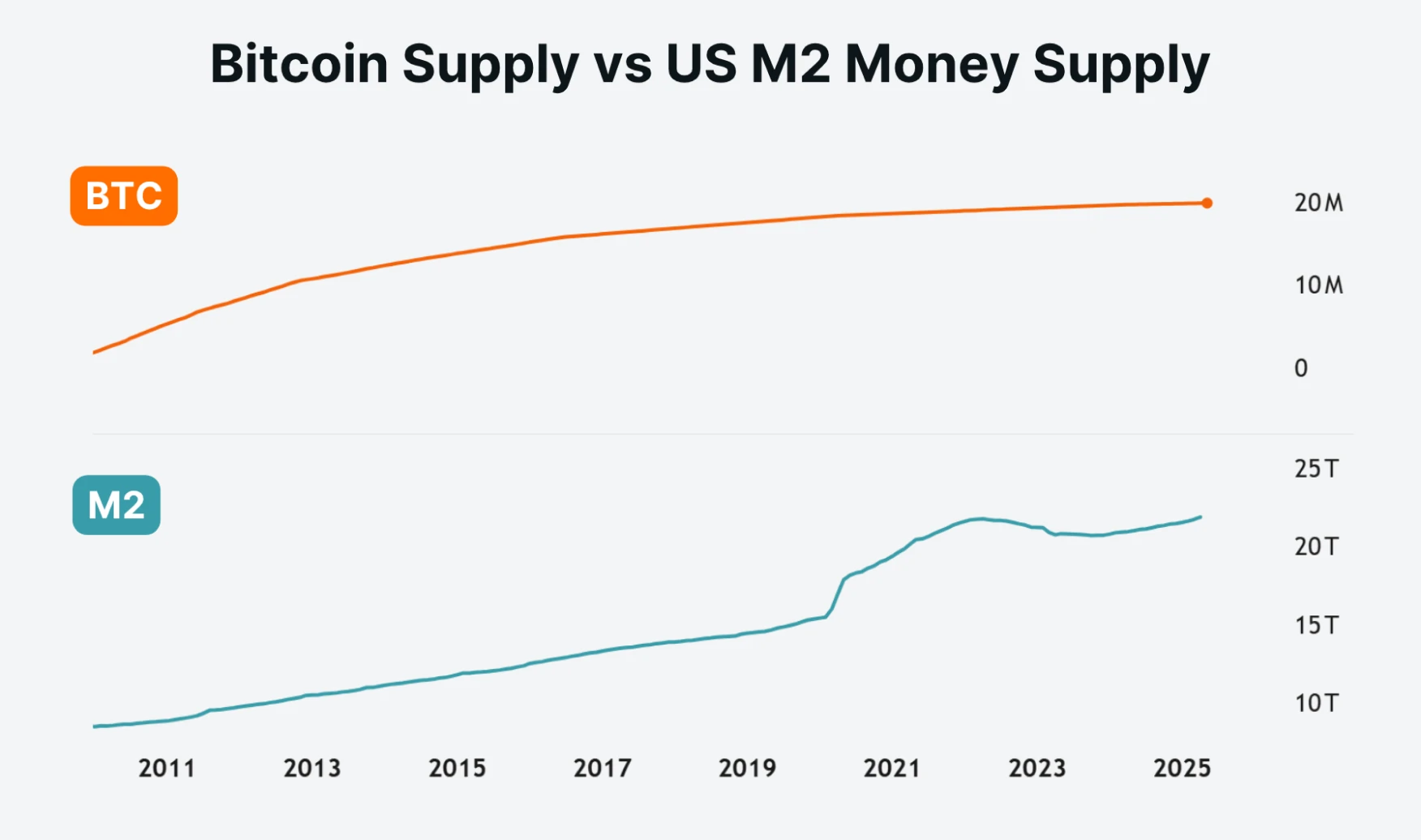

The chart below compares bitcoin’s supply growth with the growth of the US M2 money supply. M2 tracks all the dollars in circulation, including cash in checking, savings, and money market accounts.

Source: TradingView | As of May 30, 2025

Bitcoin’s supply increases more slowly over time, thanks to how the bitcoin mining algorithm works. Every four years, the number of new coins created by miners halves. With that math, around 95% of all the bitcoin that will ever exist is already minted. It will take over 100 years to mine the rest – until the year 2140.

If history is a guide, the global money supply is likely to grow much more than bitcoin’s over time. That’s why some investors might hold bitcoin in their portfolios.

Reason 2: Diversification

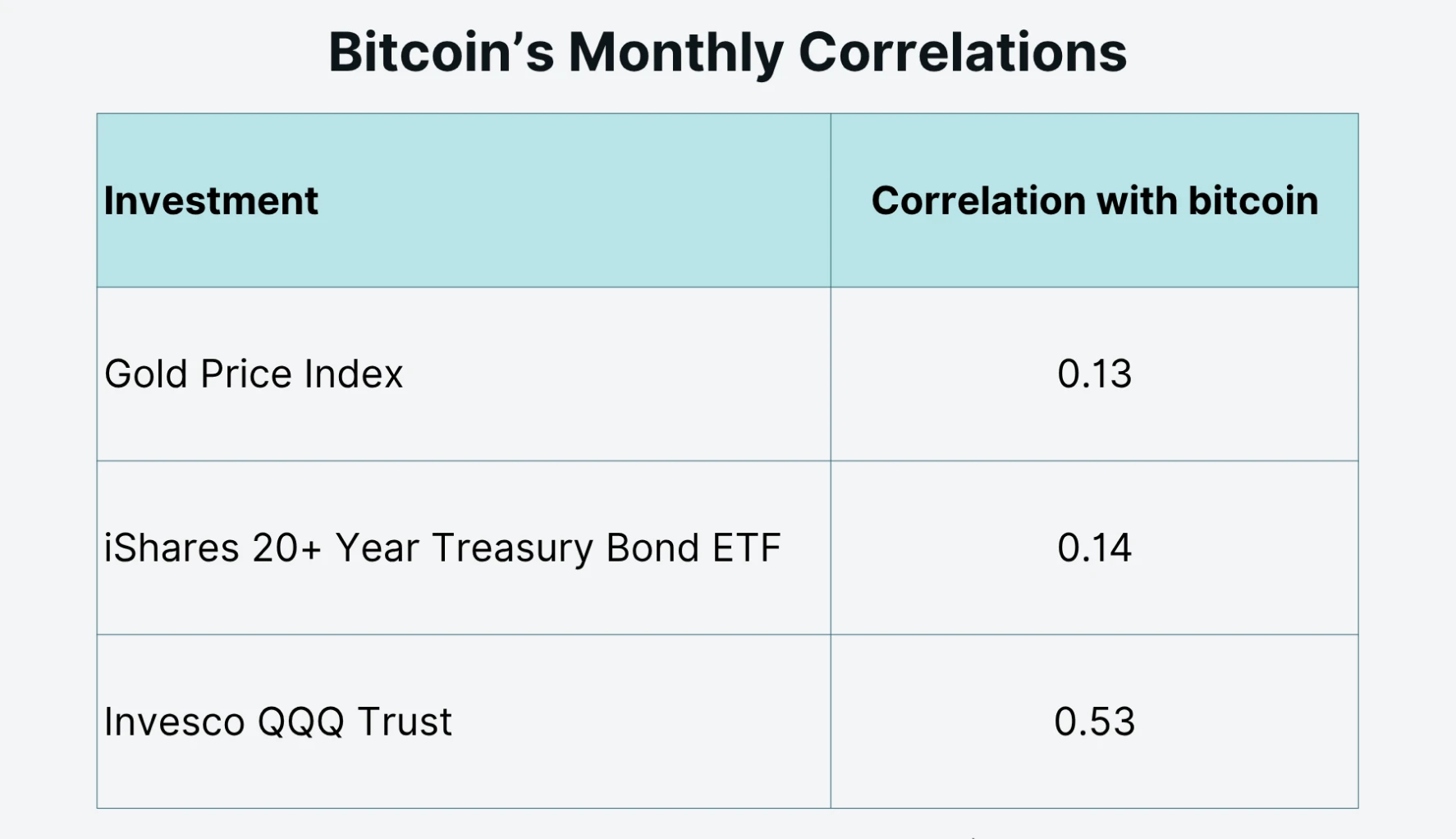

Bitcoin has also caught the attention of investors looking to diversify their portfolios. In the past, it hasn’t moved in lockstep with traditional assets like stocks, bonds, or gold.

We can measure that using correlation coefficients, which range from -1 to +1. A value of +1 means two assets move exactly together. A value of -1 means they move in opposite directions. Typically, anything below +0.5 is considered useful for diversification – it means the asset behaves differently enough to help smooth out returns.

From January 2020 through December 2024, bitcoin’s monthly returns had low correlations with gold (0.13) and long-term US Treasury bonds (0.14, via the TLT ETF). Its correlation with the Nasdaq 100 (QQQ) was higher at 0.53, but still low enough for some diversification benefits.

Source: Portfolio Visualizer | Jan 2020 to Dec 2024

Reason 3: Institutional access and regulatory acceptance

In the early days, bitcoin was hard to buy and even harder to store safely. Investors had to navigate crypto exchanges, self-custody wallets, and a landscape filled with technical risk. But that’s all changed.

Today, investors have more ways than ever to get exposure to bitcoin. They can hold bitcoin directly via their own wallet or through a digital asset exchange. Or, they can hold bitcoin indirectly through more traditional (and better regulated) products such as exchange-traded funds (ETFs). There are also several products for traders who want exposure to bitcoin’s price moves without owning the asset itself. For example, CME bitcoin futures.

In January 2024, “the nine” spot bitcoin ETFs (exchange-traded funds) started trading on the US stock market. These nine funds include some of the biggest names in asset management, like BlackRock, Fidelity, and Franklin Templeton. Together, they now hold about 1.2 million bitcoin for their investors – nearly 6% of the total supply.

Regulatory clarity is also improving. The US SEC now classifies bitcoin as a commodity, not a security – giving it clearer legal status than most other digital assets. And the EU’s MiCA regulation provides a clear framework for crypto in general.

Read this guide to learn how bitcoin works from a technology perspective.

Key takeaways

Bitcoin’s fixed supply and predictable issuance make it attractive as a potential hedge against inflation and monetary debasement.

Its low correlation to traditional asset classes means it may improve portfolio diversification and risk-adjusted returns.

Growing regulatory clarity and new investment products have made bitcoin more accessible to investors than ever before.