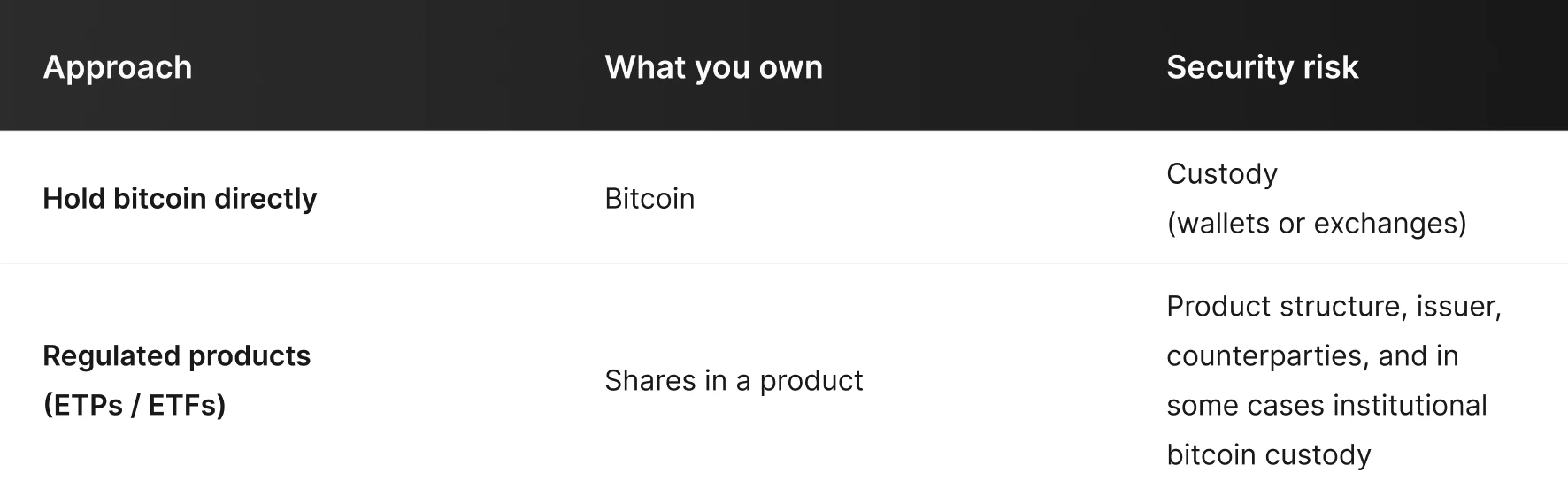

Bitcoin security depends less on the blockchain itself, and more on how investors choose to access bitcoin. Some investors own it directly, either by managing their own wallet or leaving coins on a crypto exchange. Others use regulated products that track bitcoin’s price while the investor owns shares in the product, not bitcoin itself. Both approaches can work, but they shift security risk to very different places.

Holding bitcoin directly (wallets and crypto exchanges)

Holding bitcoin directly means owning the asset itself. Whether you store it in your own private wallet or leave it on a crypto exchange, you own bitcoin.

With a private wallet, you control the private keys that unlock your coins. Those keys give you the ability to move funds on the network. If you lose them, you lose access. If you expose them, someone else can take your bitcoin. There’s no recovery process and no central authority that can reverse a mistake.

With a crypto exchange, you still own bitcoin, but the exchange controls the keys for you. That removes the need to manage wallets and backups yourself, but it introduces reliance on a third party. If the exchange freezes withdrawals, suffers a hack, or collapses operationally, access to your bitcoin may disappear.

To keep the Bitcoin network secure, miners process transactions through proof-of-work and add them to the blockchain in sequential blocks. Each new block strengthens the transaction history that came before it, which makes changes increasingly difficult.

But when you hold bitcoin directly, security risk concentrates around custody – not the security of the blockchain. Hardware wallets, multisig setups, and strong exchange controls can reduce custody risk. But they can also introduce trade-offs between control, complexity, and trust.

Using regulated products (ETPs and ETFs)

With regulated products, you don’t own any bitcoin directly. You own shares in an ETP (exchange-traded product) or ETF (exchange-traded fund).

With Bitcoin ETPs, the product may track the bitcoin price using derivatives or hold bitcoin through a third-party custodian, depending on its structure. Where an ETP uses derivatives, it doesn’t hold any bitcoin at all – so there’s no bitcoin custody risk. Instead, security risk shifts to the product structure itself. Investors rely on the ETP issuer, counterparties, and custodians to manage collateral, cash, and operational processes. Breakdowns at any of these levels can still affect the product – even if it doesn’t hold bitcoin.

ETFs share some of the same issuer and structural risks as ETPs. The funds may also hold bitcoin through a third-party custodian. And although custodians use highly secure processes, there’s still bitcoin custody risk at the institutional level.

ETPs and ETFs must both follow strict regulations. These include disclosure requirements, oversight, and clear frameworks that govern how the product operates – and what happens if something goes wrong. That doesn’t remove security risk, but it can offer clearer protections and recourse than holding bitcoin directly.

Security trade-offs at a glance

Key takeaways

Holding bitcoin directly gives full control, but it puts custody risk on the holder or the exchange they use.

Regulated products remove private key risk, but introduce issuer, structural, and institutional custody risk instead.

Regulation doesn’t eliminate security risk, but it can offer clearer protections and recourse than direct ownership.