Ether (ETH) is the commodity that powers the Ethereum network. And Ethereum users need ETH as the resource to send tokens, mint NFTs, or use its blockchain applications. But why do investors hold ETH? In this guide, we’ll explore three potential reasons.

Reason 1: Ethereum is a bet on decentralized technology

Investors often think of bitcoin as digital gold – but ether is more like a Big Tech investment in Web3 and decentralized finance (DeFi). Ethereum lets developers build and run decentralized applications (dapps) without a company or server in the middle.

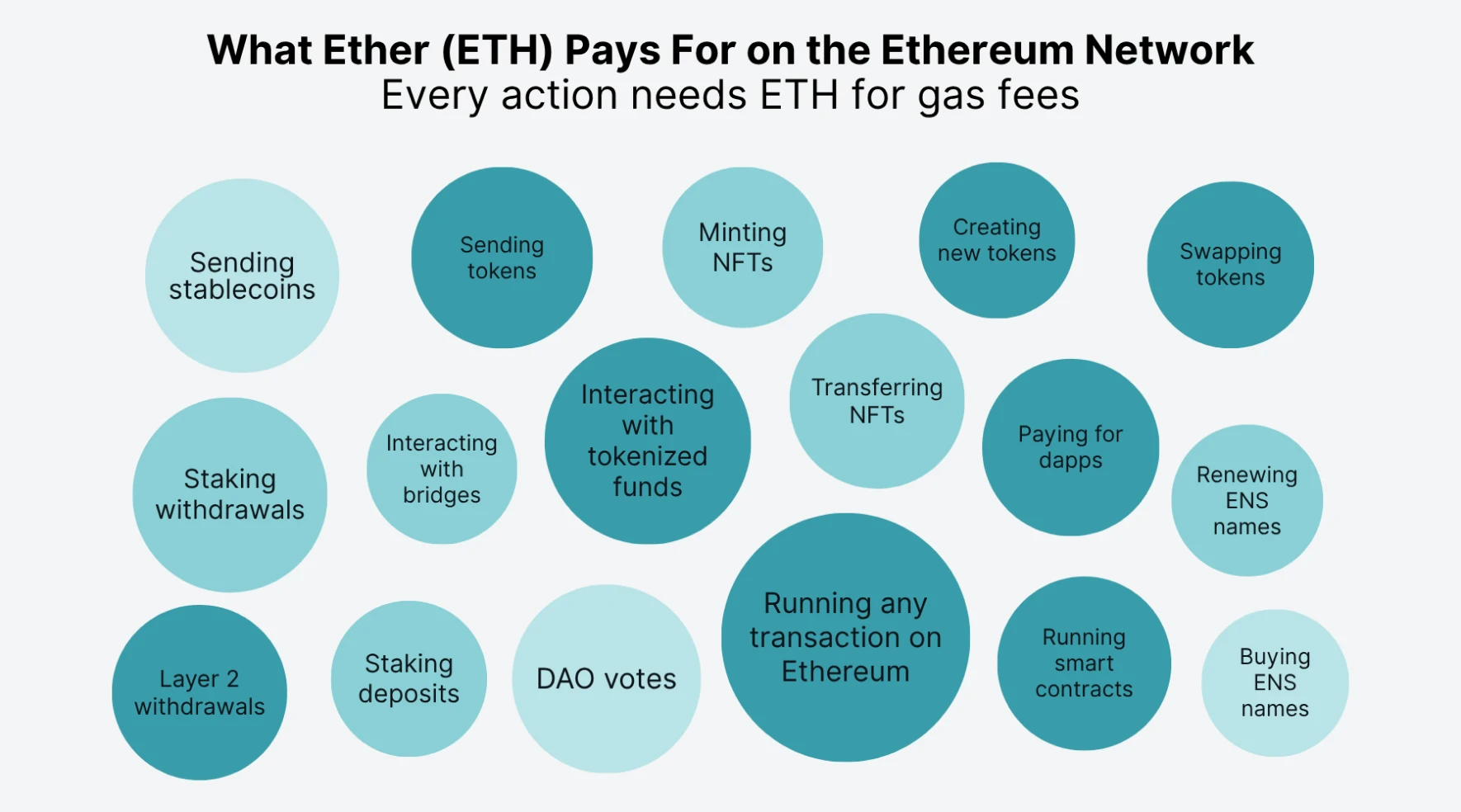

Ethereum dapps help people and businesses send money, borrow funds, or create tokens – all automatically, based on code. That code runs on the Ethereum blockchain – and uses ETH to fuel every transaction.

The image below shows some of the things ETH pays for on the Ethereum network. The more people use Ethereum, the more ETH they need to pay for activity.

Ethereum is also where most institutions are building. Asset managers like BlackRock and Franklin Templeton launched tokenized funds using Ethereum’s system. They could’ve used other blockchains – but chose Ethereum because it’s more secure and widely supported.

Owning ETH is like owning a slice of this technology stack. If the Ethereum network use keeps growing, demand for ETH may grow with it.

Reason 2: ETH can earn income through staking

Ethereum once relied on miners, like bitcoin. But in 2022, it switched to staking as part of an upgrade called “The Merge”. Now, people who own ETH can help run the network without needing expensive mining equipment – and get rewarded for it.

Here’s how staking works. Instead of mining, ETH holders “stake” their tokens by locking them into the Ethereum network. The system then randomly chooses them to process transactions. In return, they earn new ETH, plus some ETH fees from users.

This may offer investors a “staking yield”, paid in ether. The staking yield typically sits between 2.5% and 3.5%, depending on network usage and how many people are staking.

You don’t need to be a technical expert to stake ETH. Most investors stake ETH using platforms like Lido or through exchanges. Some investment products may explore staking in the future, but regulated funds typically don’t include it today.

Reason 3: The ETH supply can shrink over time

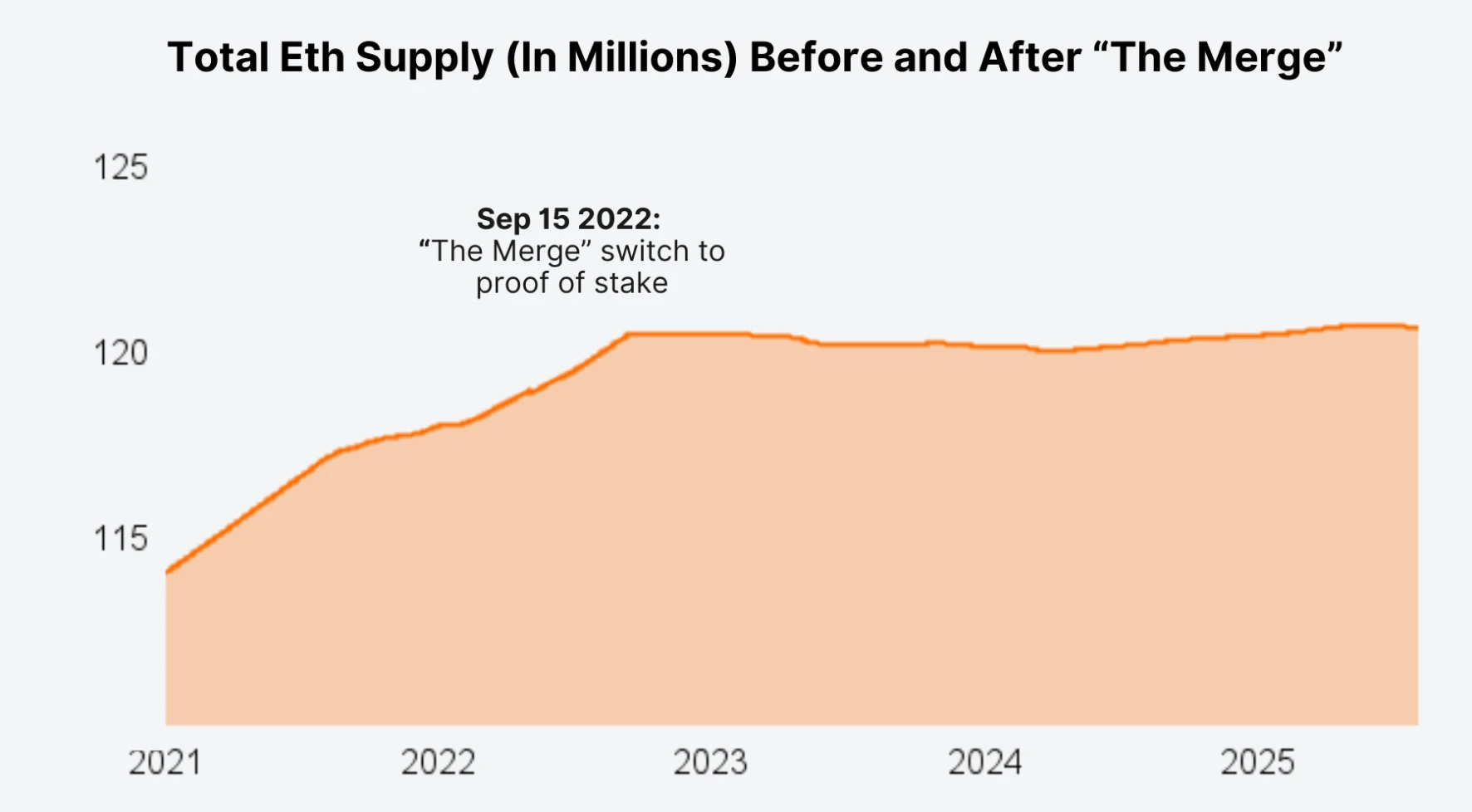

Until 2021, the ETH supply kept growing steadily, but then a major upgrade called EIP-1559 changed the rules. It introduced a system that destroys a small amount of ETH every time someone uses the network. That’s called “burning” ETH – and it reduces the ETH supply.

The Merge upgrade in 2022 then significantly cut the creation of new ETH. Stakers don’t need to cover electricity or hardware costs like miners did – so the network can pay them less ETH as an incentive.

So now, Ethereum burns ETH during periods of high activity, and creates only a small amount of new ETH for staking rewards. Sometimes, the network destroys more ETH than it creates. That means the total supply of ETH can actually go down at times.

That’s why some investors see ETH as a scarce asset.

Key takeaways

ETH gives exposure to the most used blockchain for apps, stablecoins, and tokenized assets.

ETH can generate income by staking, where holders help run the network and earn ETH rewards.

The ETH supply can shrink when network activity is high, giving it scarcity traits without having a fixed cap.