Some people see quantum computers as a potential threat to Bitcoin’s security (and value). If quantum computers get too powerful, could bad actors use them to break the network? This article explains what quantum computers are – and whether they’re actually a threat to Bitcoin.

What are quantum computers?

Regular computers store information as “bits”, which can have values of zero or one. They work through problems in a straight line, changing those bits step by step until they reach a solution. Quantum computers store information as “qubits”, which can behave like zero and one simultaneously. That allows them to explore multiple paths at once. This can make them much faster for certain kinds of calculations (but not all).

Why is Bitcoin secure today?

Bitcoin relies on two separate security mechanisms, which both involve mathematical calculations.

First, miners secure the network with specialised computers that run huge volumes of cryptographic calculations. Each calculation produces a random-looking output called a hash. Miners then repeat this process again and again until one hash meets the network’s criteria. The miner that finds a valid hash earns the right to add a new block of transactions to the blockchain. They also get freshly mined bitcoin as a reward.

This process makes the network secure because it needs massive amounts of computer resources. To change a past transaction, an attacker would need to redo all of the hashing work for that block – plus every block after it. That’s just not possible with today’s computers.

Second, wallet cryptography protects ownership by using a private key – a large random number that only the owner controls. Your wallet uses that private key to create a “cryptographic proof” before you can spend or move bitcoin. The network can easily verify that proof, but it can’t work backwards to discover the private key itself. This keeps transactions easy to check while making unauthorised spending extremely difficult.

How could quantum computers affect Bitcoin?

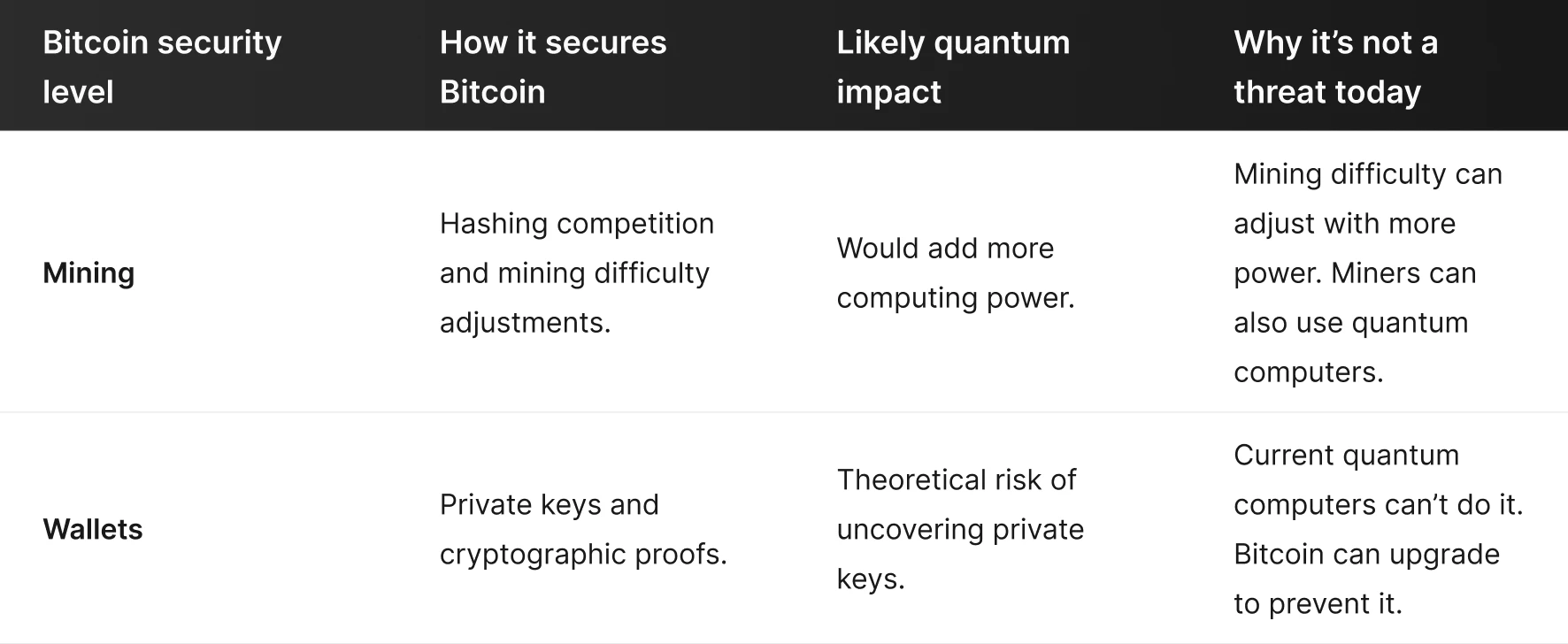

Quantum computers don’t affect all parts of Bitcoin in the same way.

Quantum computers wouldn’t automatically break the mining process. That’s because mining is a competition based on computer power. The more power miners use to compete overall, the harder it gets to find the hash. So if a few miners started using quantum computers, they would just add more power to the network. They couldn’t rewrite transactions or bypass the rules.

Not only that, but other miners would likely also start using quantum computers themselves to compete. That’s exactly what happened when mining hardware evolved from CPUs to GPUs to specialised ASIC machines.

Wallet cryptography is the more serious concern. In theory, a sufficiently powerful quantum computer could target the maths that keeps private keys “private”. It could attempt to work backwards from a public key to uncover the private key.

Today’s quantum computers are nowhere near capable of doing this. And even if they were in the future, Bitcoin wouldn’t be helpless. The network can upgrade the cryptography it uses for new addresses without rebuilding the system from scratch. That would require coordination across wallets, exchanges, and custodians.

But it would be an upgrade process, not a failure of Bitcoin’s security.

Quantum computers and Bitcoin security – mining vs wallets

Key takeaways

Quantum computers don’t automatically break Bitcoin because mining security scales with computing power and network difficulty.

The main theoretical risk is with wallet cryptography, not mining. But today’s quantum computers aren’t capable of attacking private keys.

If quantum risks ever become real, Bitcoin can upgrade its cryptography over time without rebuilding the network.