Gold has been a store of value for thousands of years, while bitcoin has only been trading since 2009. But despite that age gap, investors are starting to ask whether bitcoin could be a potential alternative to gold.

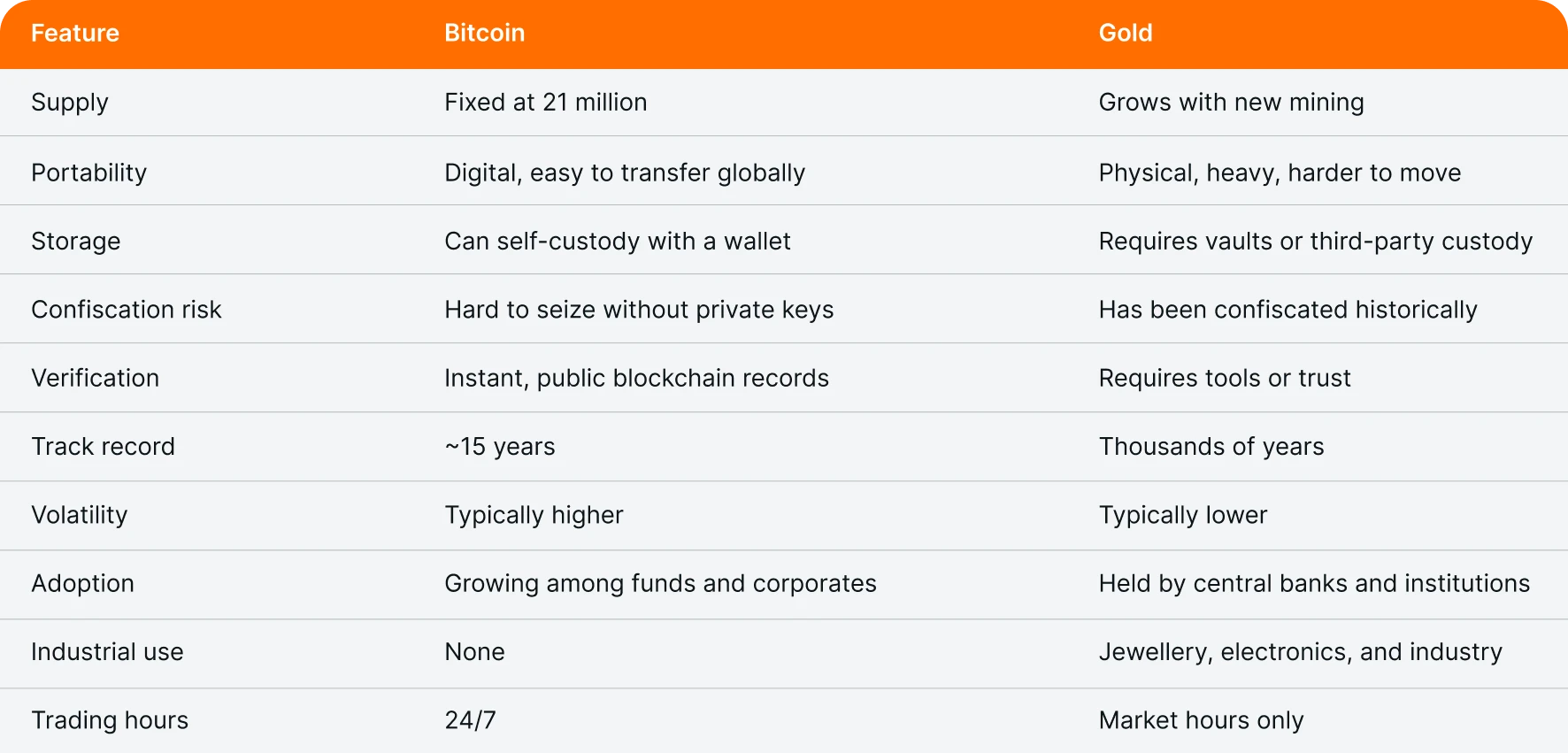

Both assets are scarce, durable, and independent of governments. They have both protected wealth against inflation and currency debasement. But they differ in several ways – and understanding those differences is essential for investors.

Supply

Gold is scarce, but not absolutely scarce. Over 200,000 tons of gold have been mined throughout history. That’s about enough gold to fill four Olympic-sized swimming pools.

The US Geological Survey estimates that there are roughly 64,000 tons of extractable gold reserves left in the earth’s crust. But as mining technology improves, the cost of extraction may fall, and miners might discover more gold.

Bitcoin, on the other hand, has a fixed supply cap: there will never be more than 21 million coins. Mathematical code enforces that limit. So even if bitcoin mining technology improves, bitcoin will still have a predictable supply schedule.

Unlike gold, miners have already mined about 95% of all the bitcoin that will ever exist. That’s because of how the bitcoin mining algorithm works – the last 5% will take over 100 more years of mining.

Source: World Gold Council & Blockchain.com | As of June 2025

Portability

Gold is physical and heavy. This can make it hard to transport across borders and expensive to store – especially in large amounts.

Bitcoin is digital. You can store it on a phone or hardware wallet and send it across the world in minutes. Whether you’re transferring $10 or $10 million worth of bitcoin, the transaction time and cost are typically the same. That makes bitcoin more efficient for cross-border transfers, especially in countries with capital controls or weak currencies.

Storage and security

Storing gold requires a secure vault. That often means paying for physical security, insurance, and third-party custody. Even then, there’s always a risk of theft or confiscation.

Bitcoin can be self-custodied. With a hardware wallet and a backup of your recovery phrase, you can store and recover your bitcoin without relying on anyone else. Of course, that also comes with responsibility: if you lose your keys, your bitcoin is gone. But for many investors, the control might be worth it.

Confiscation risk

In 1933, the US government confiscated privately held gold. They forced citizens to sell their gold to the government at a fixed price or face fines or prison time. That’s unlikely to happen today – but it shows that physical gold can be seized.

Bitcoin may be harder to confiscate than gold in practice, depending on how it’s stored. It exists on the blockchain, not in physical vaults. Unless someone has your private keys, they can’t access your funds. That may offer advantages in politically unstable environments.

Verifiability

Verifying the authenticity of gold requires tools, expertise, and trust. Fake or diluted gold exists, and it can be hard to detect.

Bitcoin is easy to verify. Every transaction is recorded on a public ledger. Anyone can check it – instantly, from anywhere. That transparency makes bitcoin harder to counterfeit or misrepresent than gold.

Track record

Gold has been around for millennia. It’s served as money, a hedge against inflation, and a safe haven in times of crisis. That long history gives it credibility and trust.

Bitcoin doesn’t have the same track record as gold. It’s still relatively new, with just over 15 years of trading history. And while it has survived a few stock market routes, it hasn’t been put to the same test as gold.

Use cases

Central banks and institutions hold gold as a reserve asset. Manufacturers use it in jewelry, electronics, and other industries.

Individuals and investment funds own most of the bitcoin in circulation. Some companies add it to their balance sheets, and a few governments have considered using it as a reserve asset. But no industries use bitcoin – it exists purely as a digital asset.

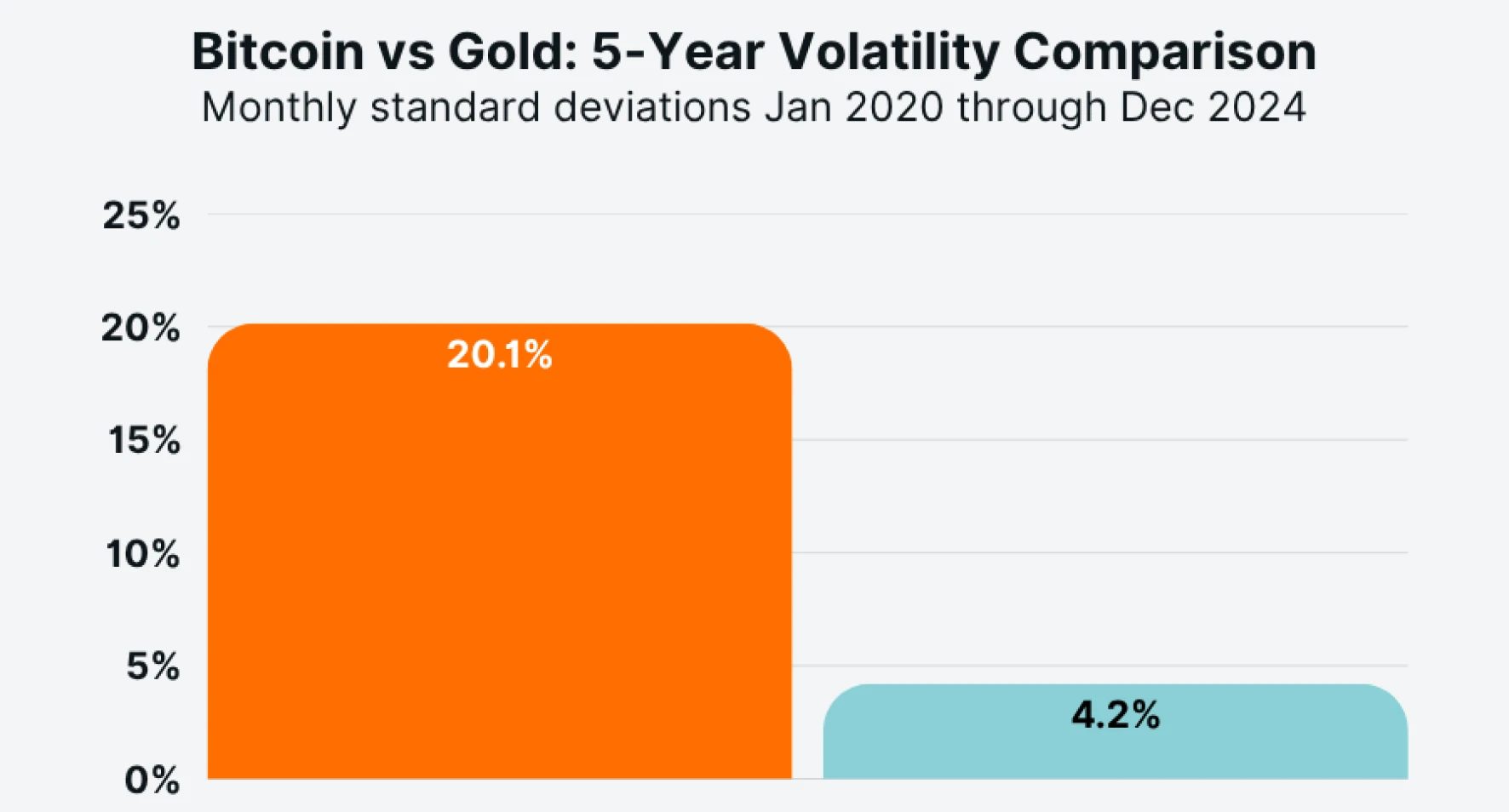

Volatility

Gold is typically more stable than bitcoin. Its price tends to move slower, reflecting its larger market size and broader level of institutional adoption.

Bitcoin tends to be more volatile, given its market value is currently less than 10% of gold’s. That volatility creates risk, but also potential opportunity. For long-term investors, those price swings may be acceptable in exchange for higher upside potential.

The chart below compares the volatility of bitcoin and gold over the five years from Jan 2020 through December 2024.

Investor access

Investors can get exposure to gold through regulated ETFs, ETPs, or directly from bullion dealers. It’s also widely available via traditional brokers and investment platforms.

Bitcoin is now just as accessible in some countries. Regulated products like bitcoin ETFs and ETPs let investors hold bitcoin without managing a crypto wallet. Bitcoin also trades 24/7 on digital asset exchanges, while gold typically trades during traditional market hours.

Just keep in mind that while access may be similar, the risks and volatility can be very different.

Key takeaways

Bitcoin is scarcer than gold. Its 21 million cap is fixed, predictable, and enforced by code.

Bitcoin is more portable and harder to confiscate. You can move it globally in minutes and store it without relying on banks or vaults.

Gold has a longer track record. It’s more stable, widely held by central banks, and has been trusted for thousands of years.