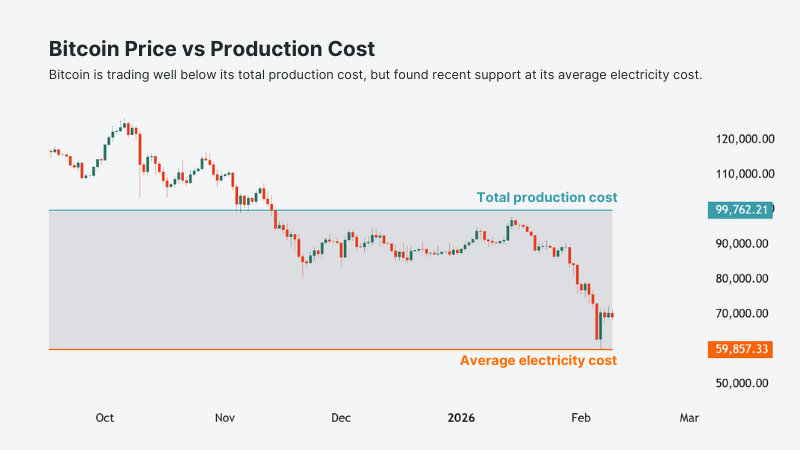

Last week, the bitcoin price tagged $60,000 before staging a recovery rally to $70,000. $60,000 was also about the average electricity cost to mine one bitcoin, according to Capriole Investments’ Bitcoin Production Cost Indicator. Historically, bitcoin has rarely traded below its average electricity cost for extended periods.

Bitcoin tagged the $60,000 level last week

The chart below shows bitcoin’s fall last week. On Friday, 6 February, it reached the $60,000 level. The orange line shows the average cost to mine a single bitcoin – currently at $59,857. That’s eerily close to where bitcoin caught a bid.

The teal line is the “total bitcoin production cost”. That includes the average electricity cost plus other operational costs to produce one bitcoin, like mining hardware, maintenance, and infrastructure. That’s currently at $99,762, according to the indicator. Bitcoin has traded below its total production cost since mid-November.

Source: Capriole Investments via TradingView | As of 9 February, 2026

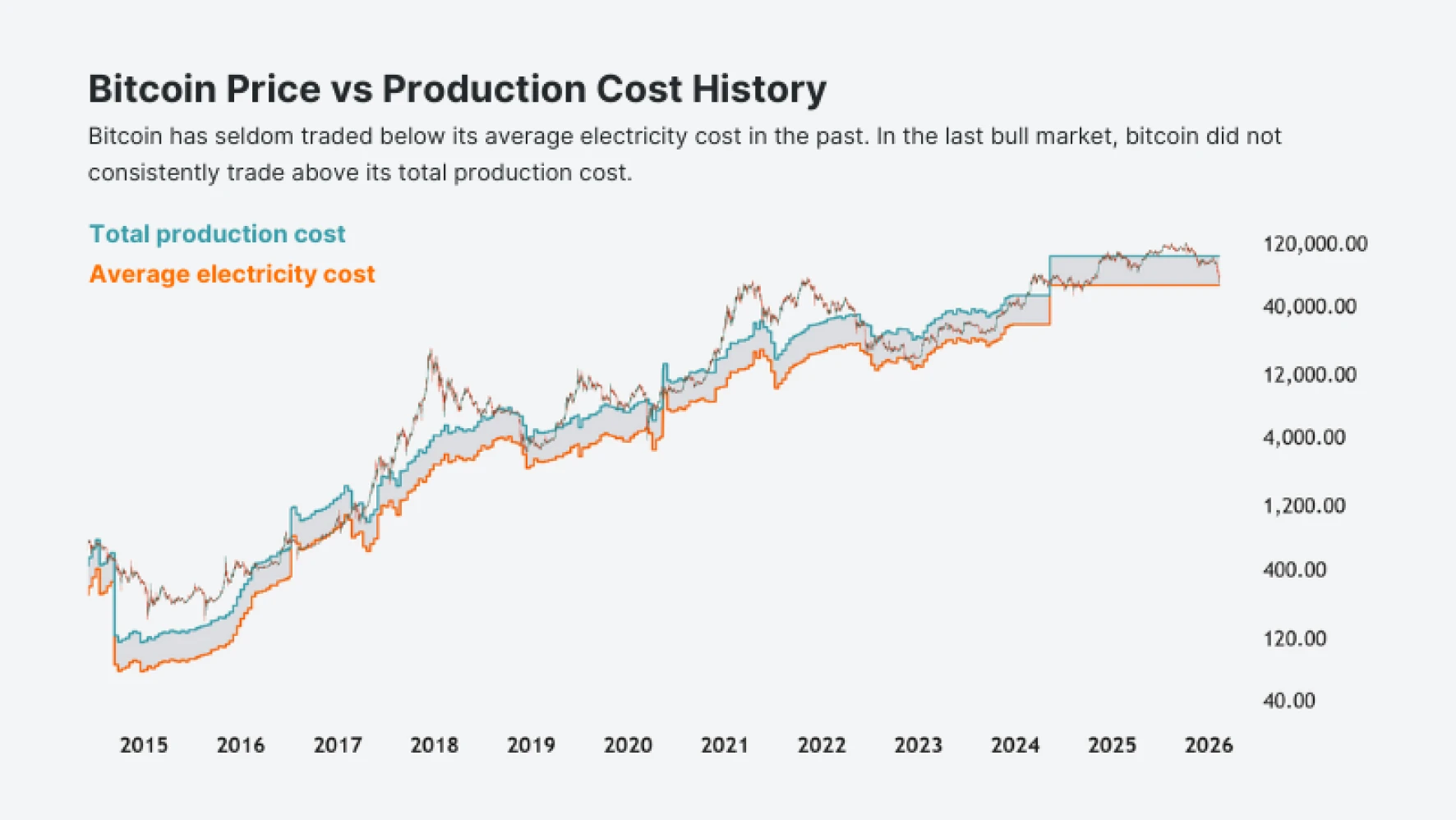

Bitcoin’s long-term relationship with production costs

The next chart shows how bitcoin has interacted with its total production cost and average electricity cost since 2015.

Source: Capriole Investments via TradingView | As of 9 February, 2026

Two observations stand out:

First, bitcoin has seldom traded below its average electricity cost in the past. Even during extreme corrections like the 2020 Covid crash and the 2022 FTX bankruptcy, it only traded slightly below it. And for a very brief period.

Second, bitcoin hasn’t traded very far above its total production cost in the last bull market. This differs from prior bull runs, where the price traded significantly above the production cost – and stayed above it for longer.

Put differently, bitcoin has spent much of the recent cycle trading between its average electricity cost and total production cost. That makes the area between these two lines a useful reference range. Selling pressure has tended to increase near the production cost level. And buyers have re-emerged near the electricity cost level.

Leverage Shares offers 3X leveraged long and short bitcoin exchange-traded products.

Key takeaways

Bitcoin tagged its average electricity cost, and buyers stepped in.

Bitcoin has spent little time below its electricity cost historically.

Bitcoin has mostly traded below its production cost this cycle, rather than far above it as in prior cycles.