Bitcoin is often described as digital gold – but there’s more to it than that. It’s a decentralized network for storing and transferring value, without a central bank or payment processor in the middle. In this guide, we’ll break down exactly what Bitcoin is and how it works – in simple, non-technical language.

What is Bitcoin?

Bitcoin is both a digital currency (bitcoin with lowercase “b”) and a blockchain network (Bitcoin with an uppercase “B”).

Anyone can automatically send, receive, and store bitcoin on the Bitcoin blockchain – without using a bank or financial middleman. That’s because no one controls the blockchain. Instead, it runs on open software. And a vast, global network of computers called “nodes” share control.

The blockchain records all bitcoin transactions publicly. Anyone can see them at any time, but they can only see the wallet addresses involved. They can’t see any personal information (like names and home addresses). In other words, bitcoin transactions are pseudo-anonymous.

Once the network “confirms” a bitcoin transaction, no one can ever block, change, or reverse it. And it stays on the public blockchain forever.

How did Bitcoin start?

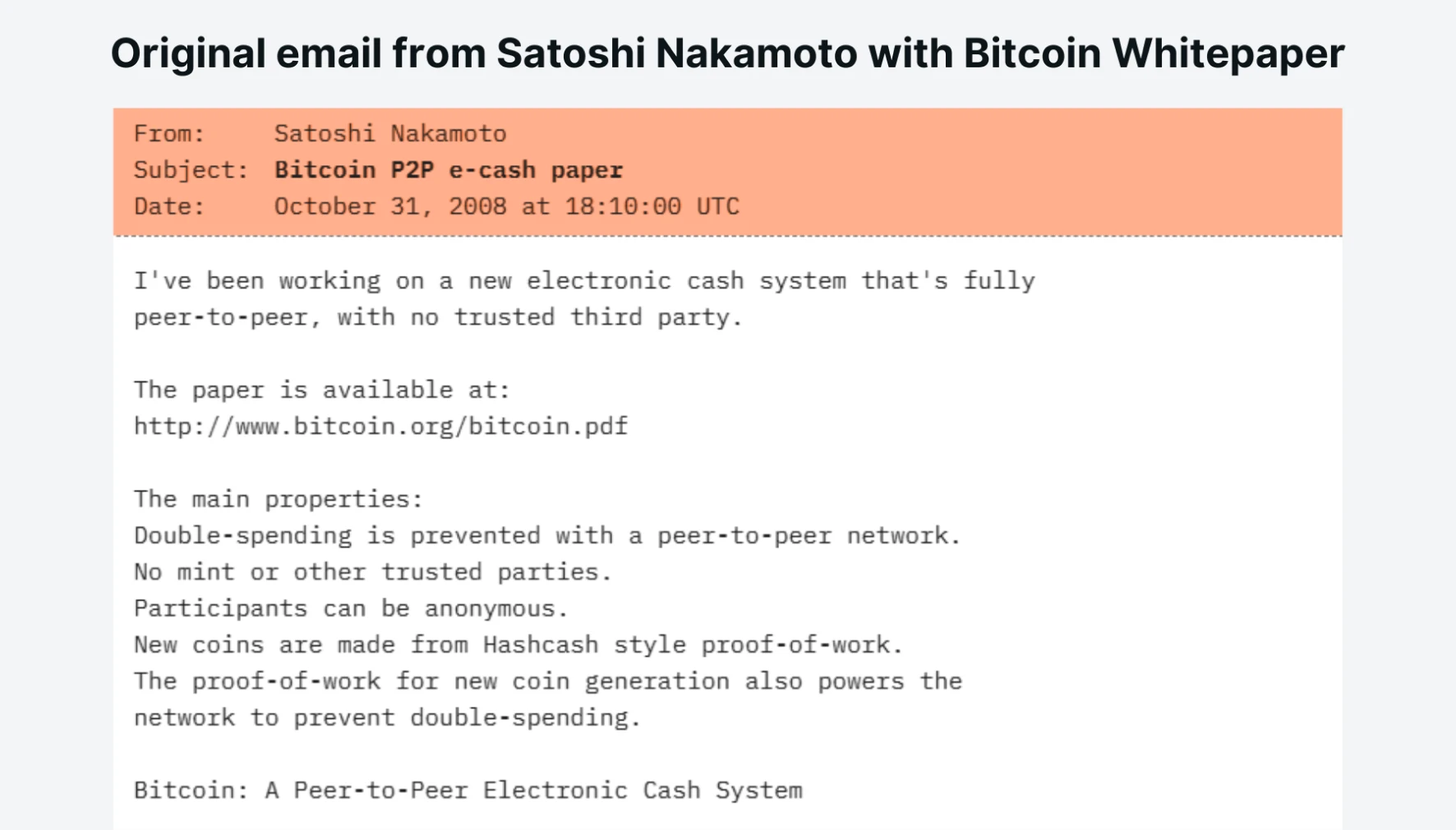

Satoshi Nakamoto (Bitcoin’s anonymous creator) emailed the Bitcoin whitepaper to a group of computer scientists on October 31, 2008. The 9-page document explained the maths behind Bitcoin and blockchain.

The group was trying to solve a complex computer science problem called “double spending”. That’s the risk of someone copying and reusing the same digital money twice, without a central authority keeping score. Satoshi's paper solved that problem.

Source: Nakamoto Institute (satoshi.nakamotoinstitute.org).

The group worked fast to implement the theory the Bitcoin whitepaper laid out. Just over two months later, on January 12, 2009, Satoshi sent the first ever bitcoin transaction over the blockchain. Bitcoin’s anonymous creator sent 10 bitcoin (BTC) to Hal Finney, a respected cryptographer and early Bitcoin adopter. The rest was history.

Key terms to understand about Bitcoin

As far as the tech goes, here are some key terms to understand about Bitcoin:

Blockchain: The Bitcoin blockchain is a public digital ledger. It records every transaction ever made on the network, and stores it indefinitely. Think of it like a database that everyone can access, but no one can change.

Blocks: Bitcoin transactions group into blocks with a few thousand others at a time. New blocks link to the blockchain roughly every 10 minutes. This creates a chain of blocks (i.e., a blockchain).

Satoshis: Each unit of bitcoin can be divided into smaller units called satoshis (or “sats”). One bitcoin equals 100 million satoshis.

Cryptography: Bitcoin uses a cryptographic algorithm called SHA-256 to lock transactions and create unique digital fingerprints for each block.

Hash: A hash is that unique digital fingerprint of data. It’s a 64-character string of letters and numbers, and every block has one.

Public key: This is like your Bitcoin username. You can share it with others so they can send you BTC.

Private key: This is your password – it proves you own your bitcoin. If someone gets your private key, they can take your funds from your digital wallet.

Digital wallet: A digital wallet stores your private and public keys. It lets you send, receive, and manage your bitcoin.

Bitcoin mining: Bitcoin miners securely process bitcoin transactions. The mining process is also what creates new bitcoins (hence the word “mining”).

How does bitcoin mining work?

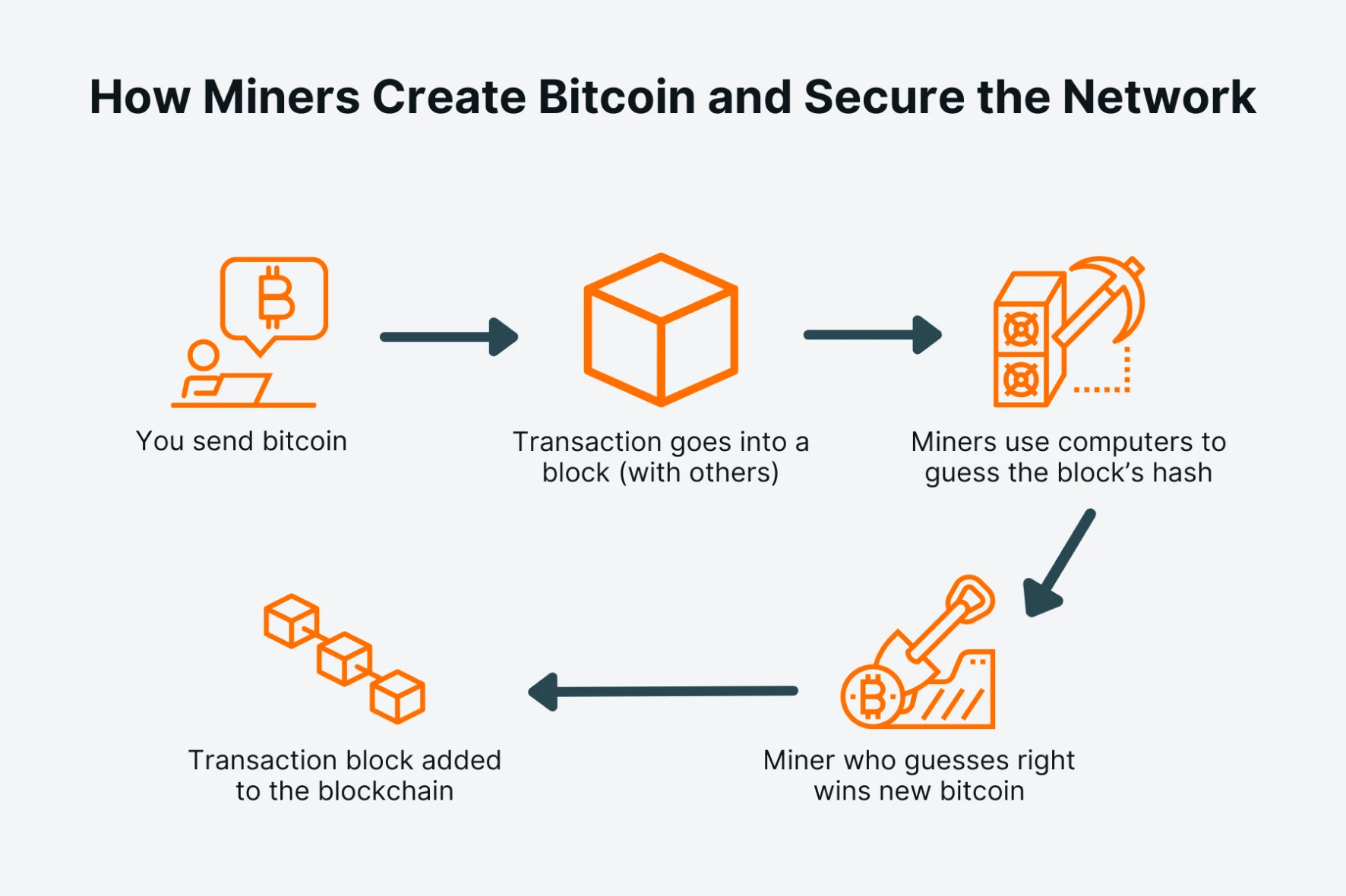

Mining allows users to send bitcoin across the network securely. Here’s an example to explain how it works.

Let’s say Alice wants to send Bob half a bitcoin (50 million sats). First, this transaction goes into a block with a few thousand other bitcoin transactions. Next, Bitcoin’s SHA-256 algorithm locks that block by creating a hash (unique digital fingerprint). Finding that hash is like searching for a needle in a haystack.

While no single computer can crack SHA-256 encryption, millions of mining machines working together can. Each miner runs trillions of computations per second, racing to be the first to randomly guess the correct hash for the current block.

Once a mining machine finds that hash, it “unlocks” the block of transactions. The miner broadcasts the hash to the Bitcoin network, which verifies it and adds the block to the blockchain. The network then creates new bitcoins and sends them to the winning miner as a reward.

The above process is called proof-of-work (PoW). The hash is the proof the network needs to process the transaction securely and reward the miner with bitcoin.

What happens after mining a block?

Once a new block is mined (which takes about 10 minutes on average) it links to the end of the blockchain – and the race begins again. As more blocks stack on top of a prior transaction, it becomes exponentially harder to reverse or change. That’s because the attacker would have to re-mine all the blocks that came after it, plus catch up with the current one. And they’d need to do this in real time, against the rest of the network.

Changing a bitcoin transaction is practically impossible (computationally infeasible) after six blocks (about an hour). But even after just one block (about 10 minutes), you’d need more than half the computer power of the entire Bitcoin network to pull it off. That’s more power than any company, government, or entity could muster.

What happens when all the bitcoins are mined?

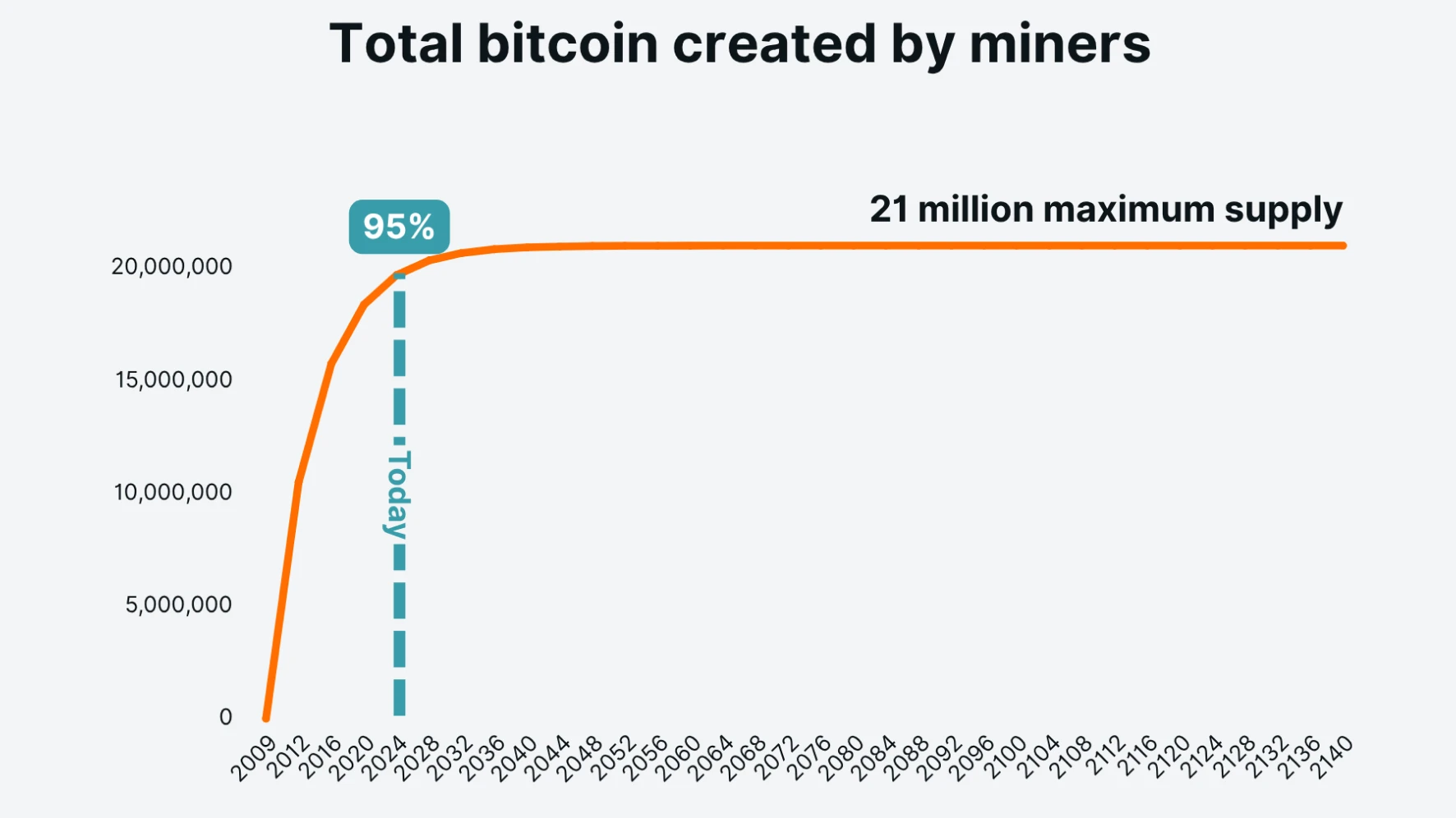

Bitcoin’s supply is capped at 21 million coins – and that scarcity is what tends to drive its value. Nearly 20 million have been produced by miners so far (about 95% of the total coin supply).

Notice in the chart below how the supply increased faster in Bitcoin’s early years, and slower today. That’s because there’s a bitcoin “halving event” every four years, where the supply of new coins created by miners halves.

So what happens when there’s no more bitcoin left to mine?

Miners will keep earning transaction fees. Today, those fees are a small bonus on top of their block rewards. In the future, they’ll become the whole reward.

And if Bitcoin adoption keeps growing, the volume of transactions might still make mining still worth it.

Key takeaways

Bitcoin is both a currency and a network – one that runs without a bank or central authority.

Mining keeps Bitcoin secure by using energy and computer power to confirm transactions.

Bitcoin’s supply is limited to 21 million coins – and almost all have already been mined.