Ethereum is the second-biggest crypto network after Bitcoin, but it works differently and has other uses. In this guide, we'll explain what Ethereum is and how the technology works – all in plain English.

What is Ethereum?

Ethereum co-founder Vitalik Buterin explained Ethereum with an analogy. If Bitcoin is Simple Mail Transfer Protocol (SMTP), Ethereum is JavaScript. SMTP sends emails, while JavaScript lets developers build interactive apps like Facebook or Skyscanner.

Ethereum is a network for building and running decentralized apps (called dapps). Unlike the apps on your smartphone, dapps run on the Ethereum blockchain – rather than a company’s server. In other words, there’s no central point of control.

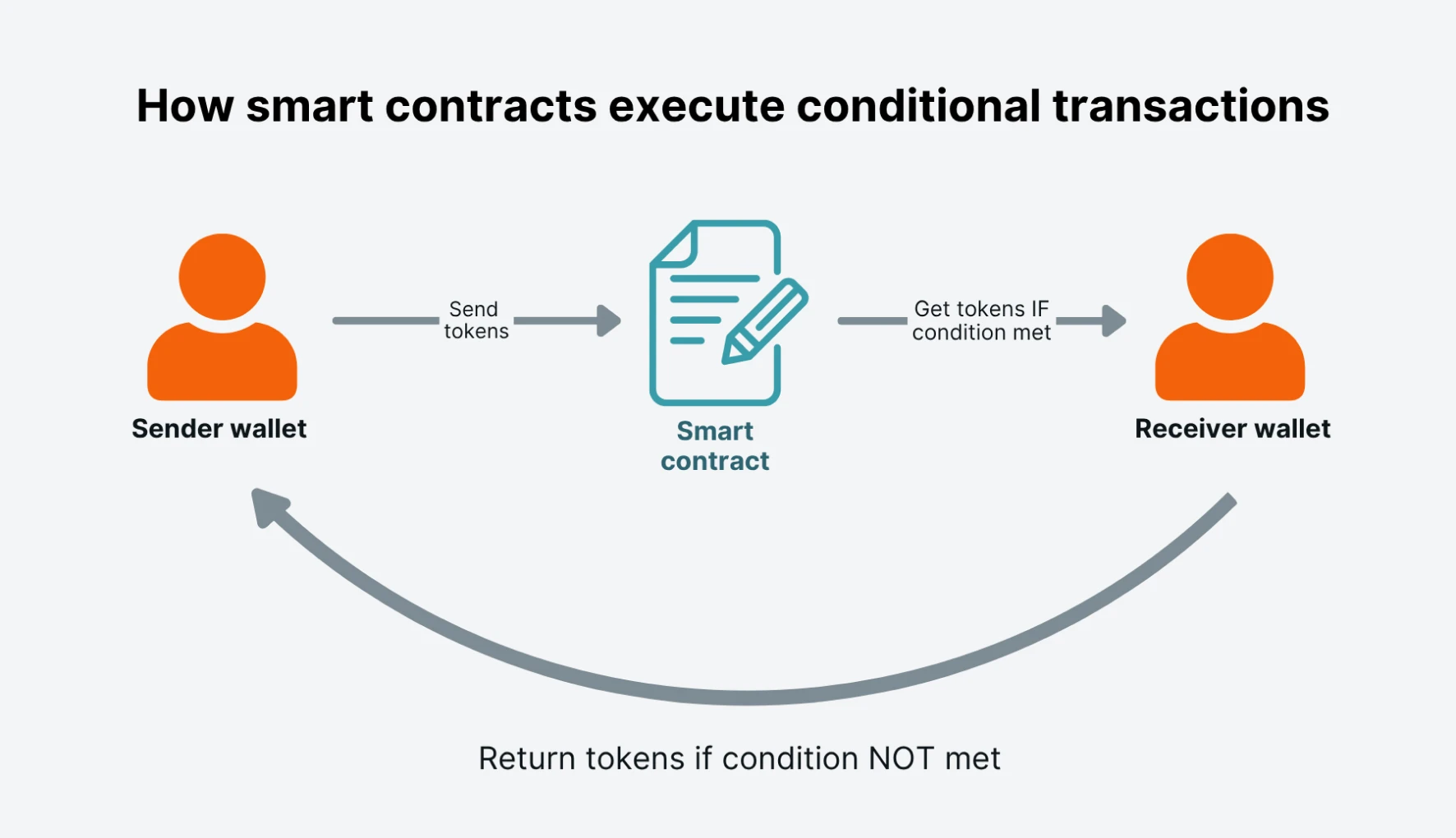

All dapps rely on smart contracts: programs that run automatically when a transaction meets certain conditions. They can move tokens, enforce rules, and react to instructions without a company or admin approving anything.

Let’s say you want to borrow a stablecoin like USDC (a crypto token that tracks the US dollar) using ether (ETH) as collateral. A lending dapp might let you lock up ETH, calculate your borrowing limit, and release the funds based on the rules in the smart contract. If your collateral drops too far, the contract automatically liquidates your position. Everything happens on the blockchain. There’s no back office and no appeals in decentralized finance (DeFi).

Apart from running complex DeFi transactions, smart contracts can also create new tokens that run on Ethereum. Those can be non-fungible tokens (NFTs), where each token is unique, or ERC-20 tokens, which act like currencies for dapps.

Every interaction with the Ethereum blockchain costs a small fee in ETH, known as gas. The more complex the action, the more gas it takes.

From mining to staking

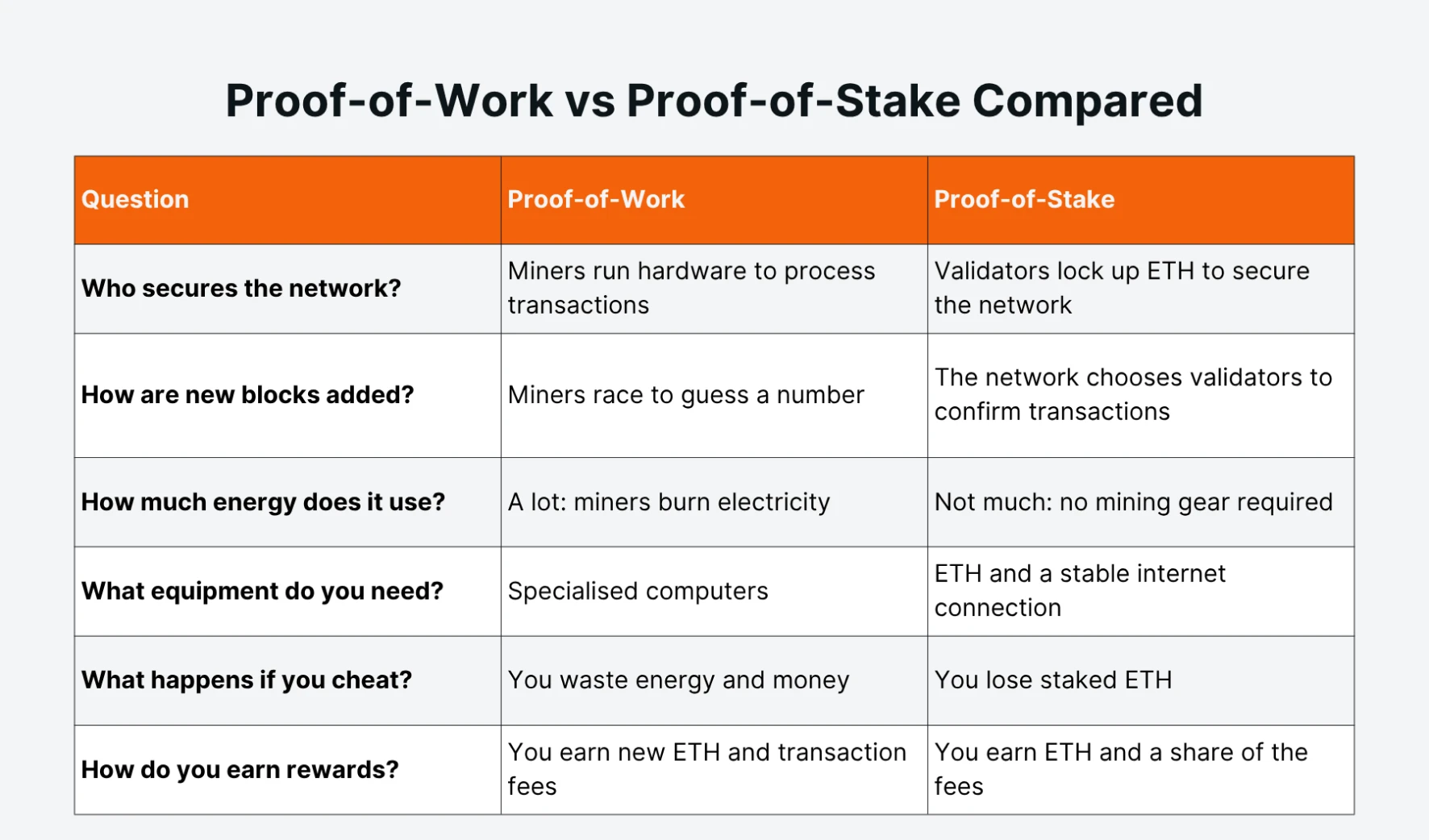

Ethereum launched in 2015 using the same system as Bitcoin: proof-of-work. In that model, miners use powerful computers to process transactions and compete to add the next block to the blockchain. They do that by guessing a random number until one of them finds a valid result that fits the network’s rules.

Proof-of-work is a secure and proven way to run a decentralized system. It still works incredibly well for Bitcoin, which focuses on securely storing and transferring value.

But Ethereum has other priorities. It runs dapps, processes smart contracts, and handles more complex transactions than Bitcoin. So with proof-of-work, Ethereum ran into bottlenecks. Blocks filled up fast, gas fees spiked, and developers had more trouble rolling out upgrades. The system was secure, but it didn’t scale well.

So in 2022, Ethereum moved to a system called proof-of-stake as part of an upgrade called “the Merge.” Proof-of-stake replaces miners with validators, who “stake” ETH instead. Here, validators deposit their own ETH into smart contracts, which lock up their ETH as collateral to process transactions and secure the network.

In return for staking, validators earn interest in ETH (which is also how new ETH is created). But if they cheat or go offline, they can lose staked ETH. That penalty keeps the system honest. Validators don’t spend electricity (like miners) – they put capital at risk instead.

Ethereum is still evolving

Ethereum is still a work in progress. The Merge was a major upgrade, but fees can still spike when the network gets too busy. That makes some dapps too expensive for everyday use – especially decentralized trading platforms, NFT projects, and blockchain games.

Developers are still working on upgrades to make Ethereum faster and cheaper to use – while maintaining its strong security. The network is becoming more efficient, but there’s still a long way to go.

That said, Ethereum is still the biggest and most active programmable blockchain. It’s where most dapp developers build first – and where most DeFi liquidity lies.

Key takeaways

Ethereum runs decentralized apps using smart contracts – not companies or servers.

It switched to proof-of-stake to support higher activity and reduce energy use.

Ethereum is the biggest and most active smart contract blockchain.