Bitcoin doesn’t pay interest, generate cash flows, or pay dividends. So how do investors figure out what it’s worth? There’s no single answer – and no perfect model. But over time, several frameworks have emerged that may offer useful ways to think about bitcoin’s value. In this guide, we’ll explain three common approaches to valuing bitcoin: miner production cost, Market Value to Realized Value (MVRV), and Network Value to Transactions (NVT).

Miner production cost: What it costs to create 1 BTC

Bitcoin mining creates new coins – and that process costs money. Miners must pay for hardware, electricity, and cooling fans to keep their machines running. Those production costs can give us a rough idea of what one bitcoin might be worth.

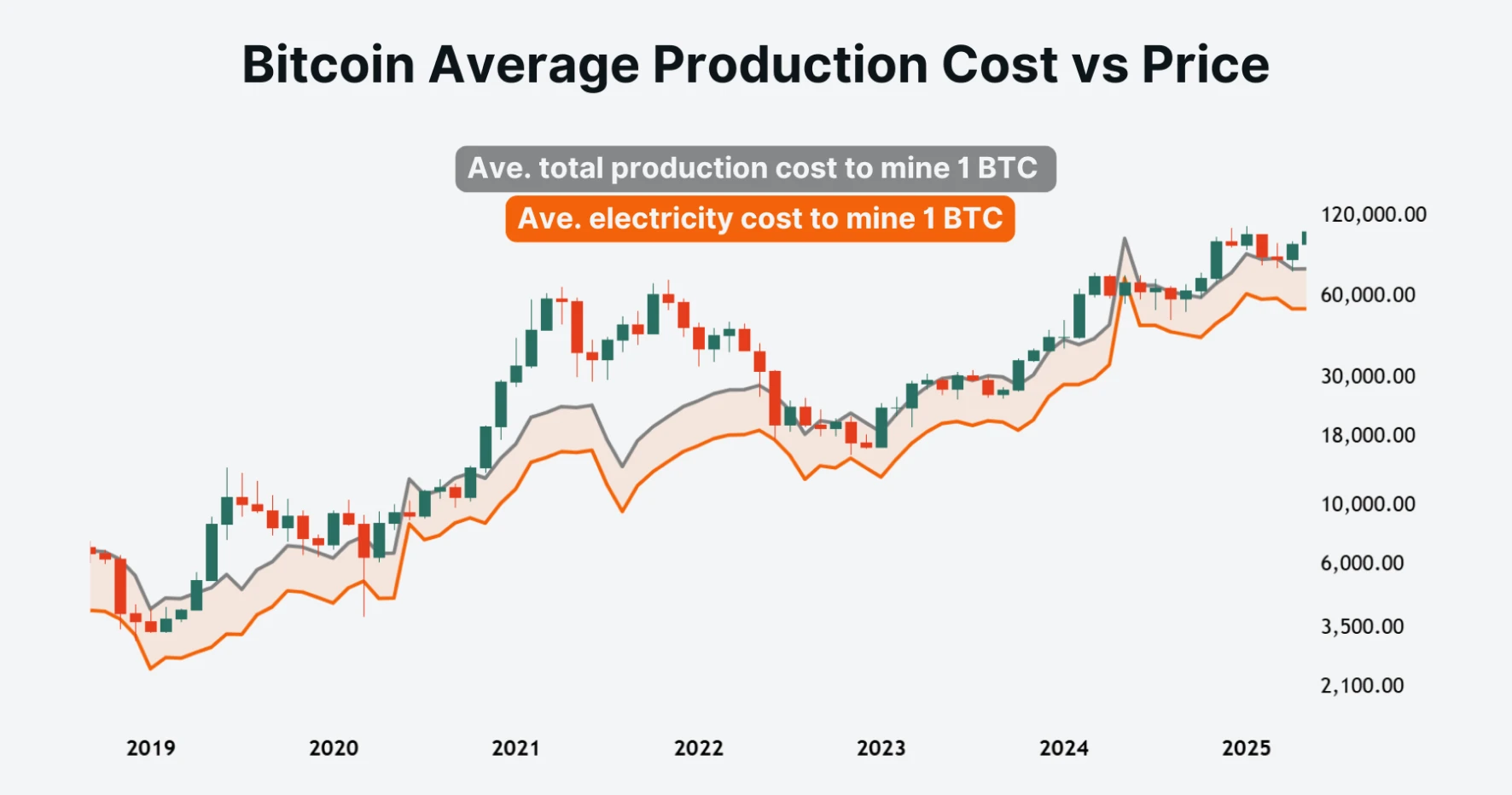

The Bitcoin Production Cost Indicator, by Capriole Investments, uses data from the Cambridge Bitcoin Electricity Consumption Index to estimate the average cost to produce one bitcoin. In the chart below:

The orange line is the average electricity cost to mine bitcoin.

The grey line is the average total production cost (which includes electricity and other operational expenses).

Source: Capriole.com, as of June 11 2025

Notice how the price of bitcoin (green and red bars) has remained above the average electricity cost on a closing basis over the past few years. Historically, buying bitcoin whenever the price approaches its average electricity cost has offered good value.

MVRV model: Market cap vs realized value

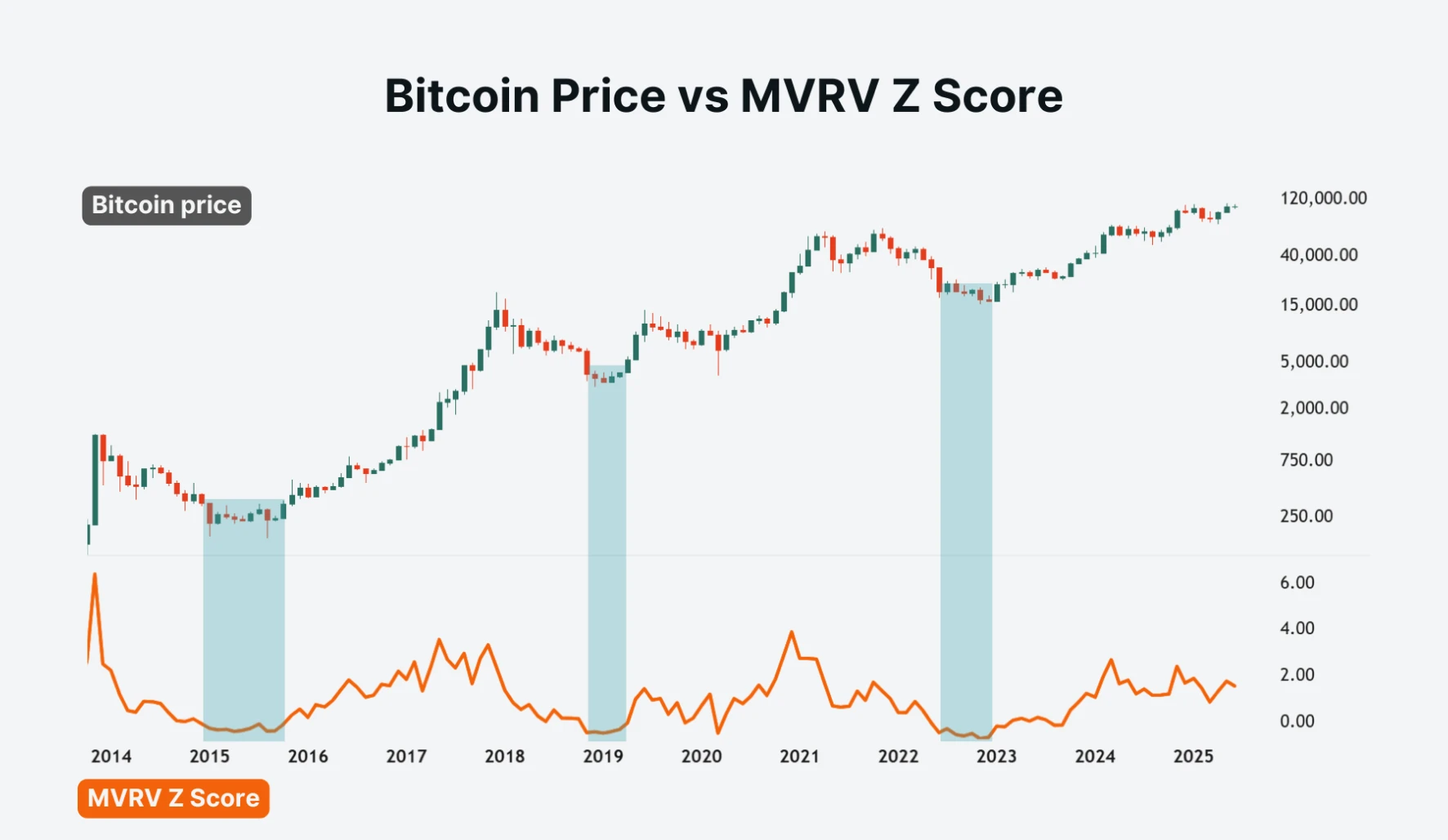

The MVRV ratio compares bitcoin’s market value to its realized value to gauge whether the asset is over or undervalued. The market value is the current bitcoin price times all the coins in circulation. The realized value is a metric that values each coin at the price it last moved on the blockchain.

Here’s an analogy to explain realized value. If a street has many houses, the realized value would be the total value of each house when their previous owner sold them. So, if someone bought one bitcoin for $20,000 in 2023 (and hasn’t moved it on the blockchain since), the model assumes it’s still worth $20,000. Add that up across all coins in circulation, and you get the network’s realized value.

The MVRV ratio divides the market value by the realized value of bitcoin. When the ratio falls below 1, it means the average investor is holding bitcoin a loss. And when the ratio is above one, it’s the opposite – the average investor is in profit.

The MVRV Z-Score takes the MVRV ratio and applies statistics to make it potentially more accurate as a bitcoin valuation model. While there are many variations of this model, the chart below shows one example of the MVRV Z-Score indicator by Da_Prof. The chart shows that lower Z-Scores have historically coincided with buying bitcoin at “good value”.

Source: MVRVZ-Multiasset [Da_Prof], TadingView, as of June 13, 2025

NVT model: Network value to transactions

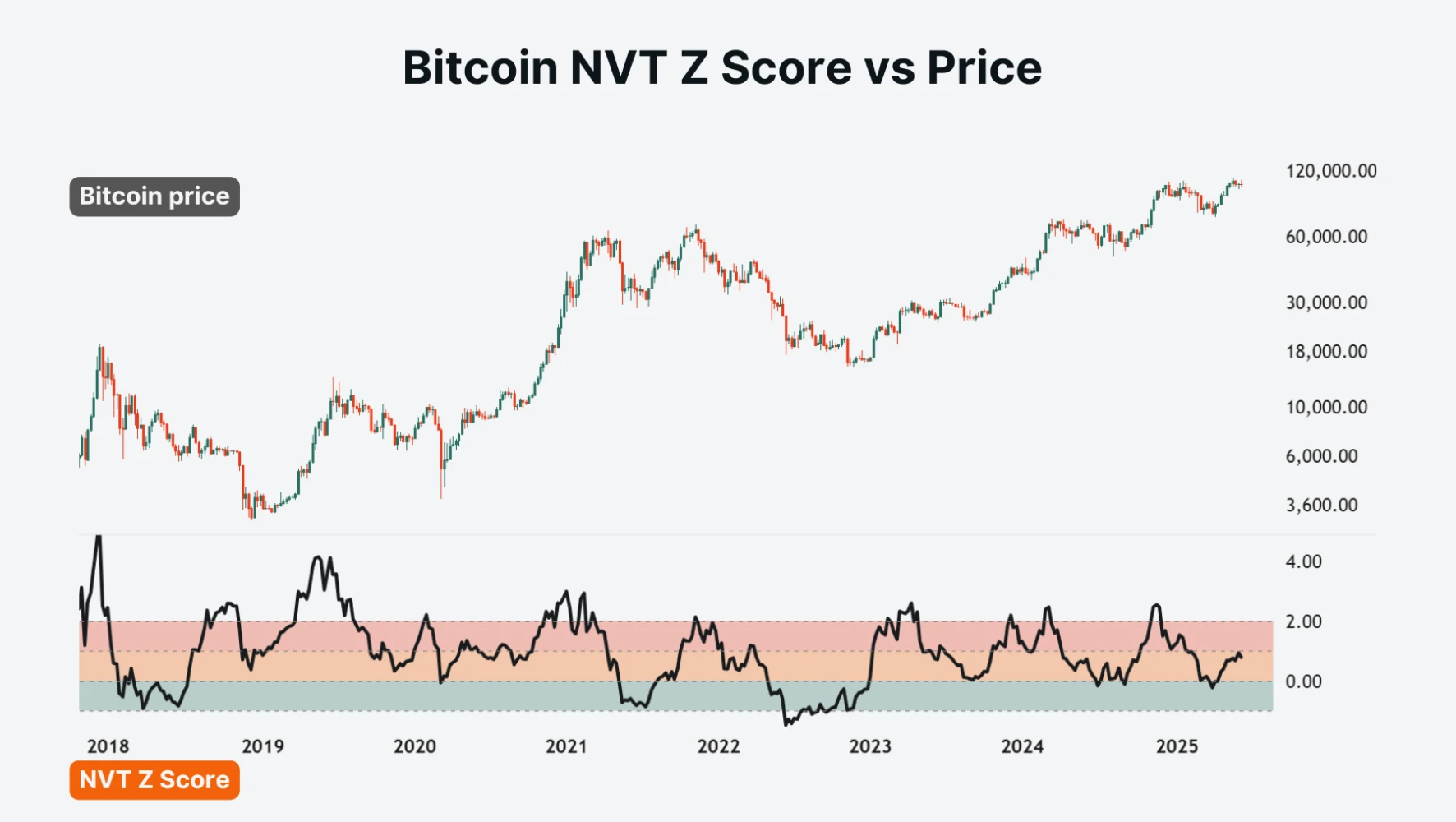

The Network Value to Transactions (NVT) ratio compares bitcoin’s market cap to the daily value of on-chain transactions. It’s often referred to as bitcoin’s price-to-earnings (PE) ratio. But instead of comparing price to earnings, it compares price to transaction volume.

If bitcoin’s market cap is rising faster than the value being transferred on its blockchain, the asset might be overvalued. If network activity is high relative to price, it could suggest undervaluation.

To improve the signal, some analysts use the NVT Z-Score, which standardises the NVT ratio using long-term average values and standard deviations. In the chart below, we’re using the NVT Z-Score indicator by Sr_KIS on TradingView.

The black line shows the NVT Z-Score. Historically, high NVT Z-Scores have coincided with bitcoin price tops, while low NVT Z-Scores have aligned with potential buying opportunities.

Source: NVT Z-Score [SR_KIS],TradingView, as of June 13, 2025

Final thoughts

Bitcoin doesn’t fit into traditional valuation models – and no single metric captures its full picture. But frameworks like miner production cost, MVRV, and NVT each highlight a different part of the story. Production cost reflects economic pressure on miners. MVRV shows where the current price sits relative to investor positioning. And NVT shows how network activity compares to market valuation – like a proxy for blockchain “earnings”.

None of these models are perfect. But together, they may offer more structure in a market that typically doesn’t follow traditional valuation models.

Key takeaways

Miner production cost gives a rough estimate of bitcoin’s value based on what it costs miners to operate.

The MVRV model compares bitcoin’s market value to realized value.

The NVT model compares market cap to blockchain activity – like a price-to-earnings ratio for bitcoin.