Leveraged crypto ETPs aim to magnify the daily price moves of digital assets like Bitcoin or Ethereum. For example, a 3X Bitcoin exchange-traded product might target three times Bitcoin’s daily move. These products can appeal to traders who want strong short-term exposure without margin accounts, crypto exchanges, or private keys. This guide explains what leveraged crypto ETPs are and how they work. We’ll also explore their potential risks and benefits, and how some traders may use them in their strategies.

What is a leveraged crypto ETP?

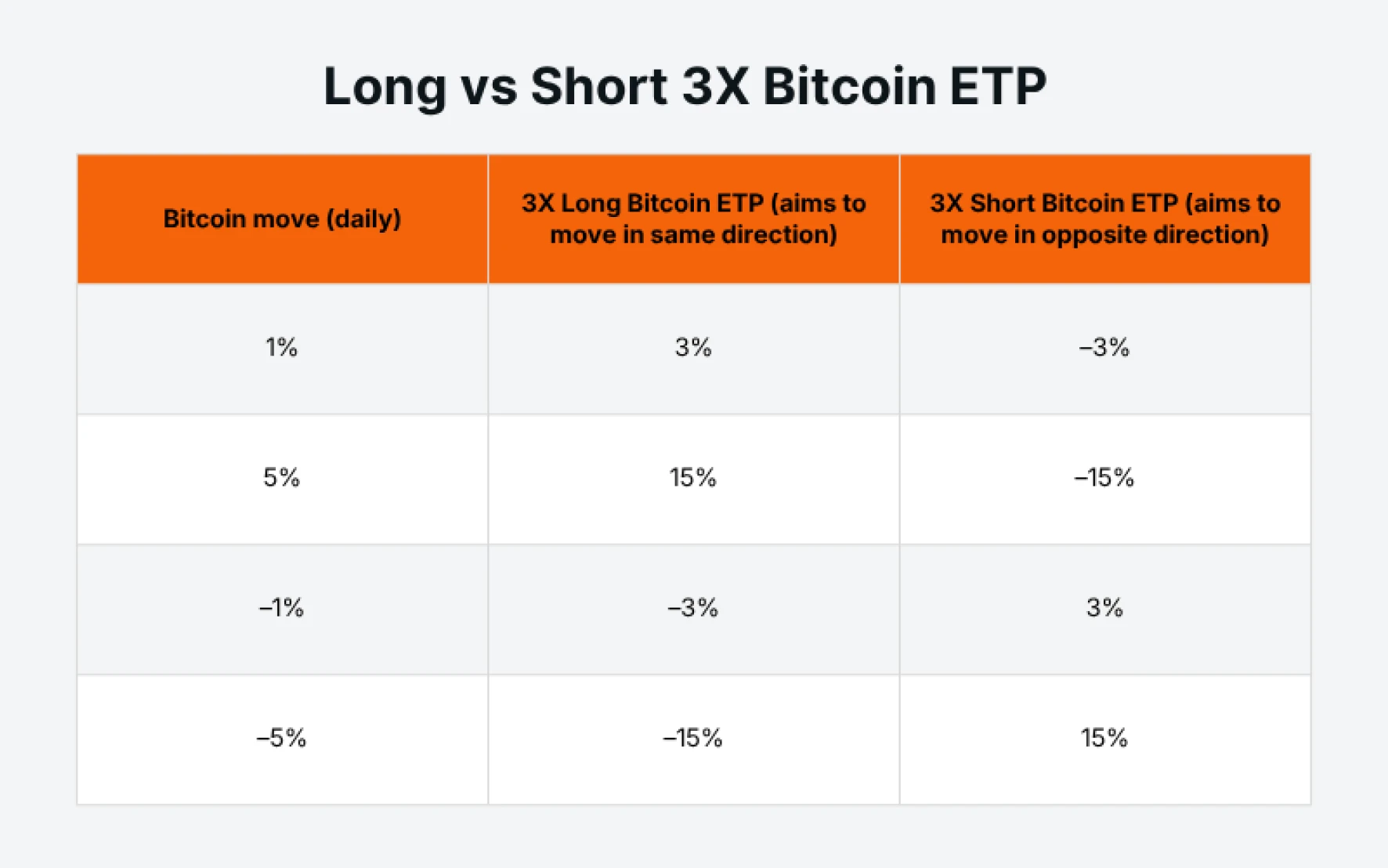

A leveraged crypto ETP is an exchange-traded product that targets a fixed multiple of a crypto asset’s daily move. For example, a 3X Bitcoin ETP aims to rise 3% when Bitcoin rises 1% that day. A 3X short version does the opposite: it aims to rise 3% when Bitcoin falls 1%.

These products trade like shares on regulated exchanges. You buy and sell them through your broker, and everything settles in traditional currencies. You never hold or transfer crypto yourself – the ETP handles the exposure on your behalf.

The key point is that leverage applies to each trading day, not longer time periods.

How leveraged crypto ETPs work

Leveraged crypto ETPs use regulated derivatives instead of holding the coins directly. Some ETPs use futures products to get leveraged exposure – like with Leverage Shares crypto products. Futures are listed contracts that use derivatives to scale exposure.

At the end of each trading day, the ETP “resets” its positions to keep the leverage on target. Without that daily reset, the leverage would drift as prices move over time.

Potential benefits of leveraged crypto ETPs

Smaller trade sizes: Leverage lets traders target larger daily price moves with less capital. A 2X or 3X product can turn a small position into a meaningful one-day exposure. This can help traders express short-term ideas without tying up large amounts of cash or using margin accounts.

No need to hold crypto: Leveraged crypto ETPs avoid wallets, private keys, and crypto exchanges. Everything happens on heavily regulated stock exchanges in the same way as share trading. That could suit traders who want to capture crypto volatility but prefer traditional market systems.

Long and short options: Long ETPs move with the asset, while short ETPs move in the opposite direction. Traders can switch between bullish and bearish views by simply buying shares in the respective ETP. This can be more straightforward than trading crypto derivatives directly.

Illustrative example. Figures are hypothetical and for education only.

Potential risks

Leverage works both ways: Leverage can magnify gains, but the same applies to losses. Bitcoin and other digital assets are notoriously volatile. And with leverage on top, losses can stack up quickly if the market goes against you.

Reset timing in fast markets: These products reset their leverage once per day. A big move before that reset could create results that differ from a simple 2X or 3X expectation. Prices can also jump during busy trading periods, which can affect the price you get when you buy or sell.

“Compounding” can change multi-day returns: Leveraged ETFs “rebalance” each trading day to re-target the stated leverage factor. The more trading days you hold a position, the bigger the potential for “compounding risk”. That’s especially true when crypto prices don’t move in a straight line (which is often the case).

Compounding example: 3X Leveraged Bitcoin ETP

Here’s a simple two-day example to show how compounding can affect returns.

Assume Bob invests $1,000 in Bitcoin, and Alice invests $1,000 in a 3X Bitcoin ETP.

On day one: Bitcoin rises 5%, so Bob’s investment grows to $1,050. Alice’s ETP rises 15% the same day, so her $1,000 becomes $1,150.

On day two: Bitcoin falls 5%, and Bob’s value drops to $997.50. The 3X ETP falls 15% that day, which takes Alice’s $1,150 down to $977.50.

Bob ends the two days with a small loss, but Alice ends with a bigger loss because of compounding.

Illustrative example. Figures are hypothetical and for education only.

This two-day example also shows how compounding can push returns away from a simple “3X path”. That gap can grow when prices jump around, because each day’s move hits a new base value. Strong trends can work in favour of a leveraged product, while choppy markets can work against it.

The key point is that multi-day returns will rarely match a clean 3X calculation. That’s because the product resets each day rather than carrying the same exposure through time.

How traders might use leveraged crypto ETPs

Leveraged crypto ETPs may suit traders with short-term ideas on Bitcoin or Ethereum. They do not suit long-term investing because they focus on daily moves. Some traders might use long products when they expect the asset to rise. Others may use short versions when they expect a market drop or want a temporary hedge.

Appropriate position sizing is crucial – as leverage cuts both ways. Especially in crypto, where markets can turn on a dime.

Leverage Shares currently offers 3X long and short crypto ETPs for Bitcoin and Ethereum.

Key takeaways

Leveraged crypto ETPs aim to magnify the daily move of assets like Bitcoin and Ethereum through regulated stock exchanges.

These products use derivatives and collateral to offer 2X or 3X exposure without crypto wallets or margin accounts.

Daily resets and compounding mean multi-day returns can drift from a simple 2X or 3X calculation, especially when prices jump around.

FAQs

Do leveraged crypto ETPs hold actual crypto? No. They use derivatives and collateral for exposure.

Can I lose more than I invest? No. Losses are limited to your investment.

Do all leveraged crypto ETPs use futures? Many do. Structures vary by issuer.

Are they suitable for long-term investing? No. They focus on daily moves and work best for short-term trading.