Many investors see MicroStrategy (now “Strategy”) as leveraged Bitcoin exposure. Strategy now holds 650,000 Bitcoin – around 3% of the total 21 million supply. With the world’s largest Bitcoin corporate treasury, its stock price is typically correlated with the Bitcoin price. But the two investments don’t always move in line.

Correlation between Bitcoin and MicroStrategy

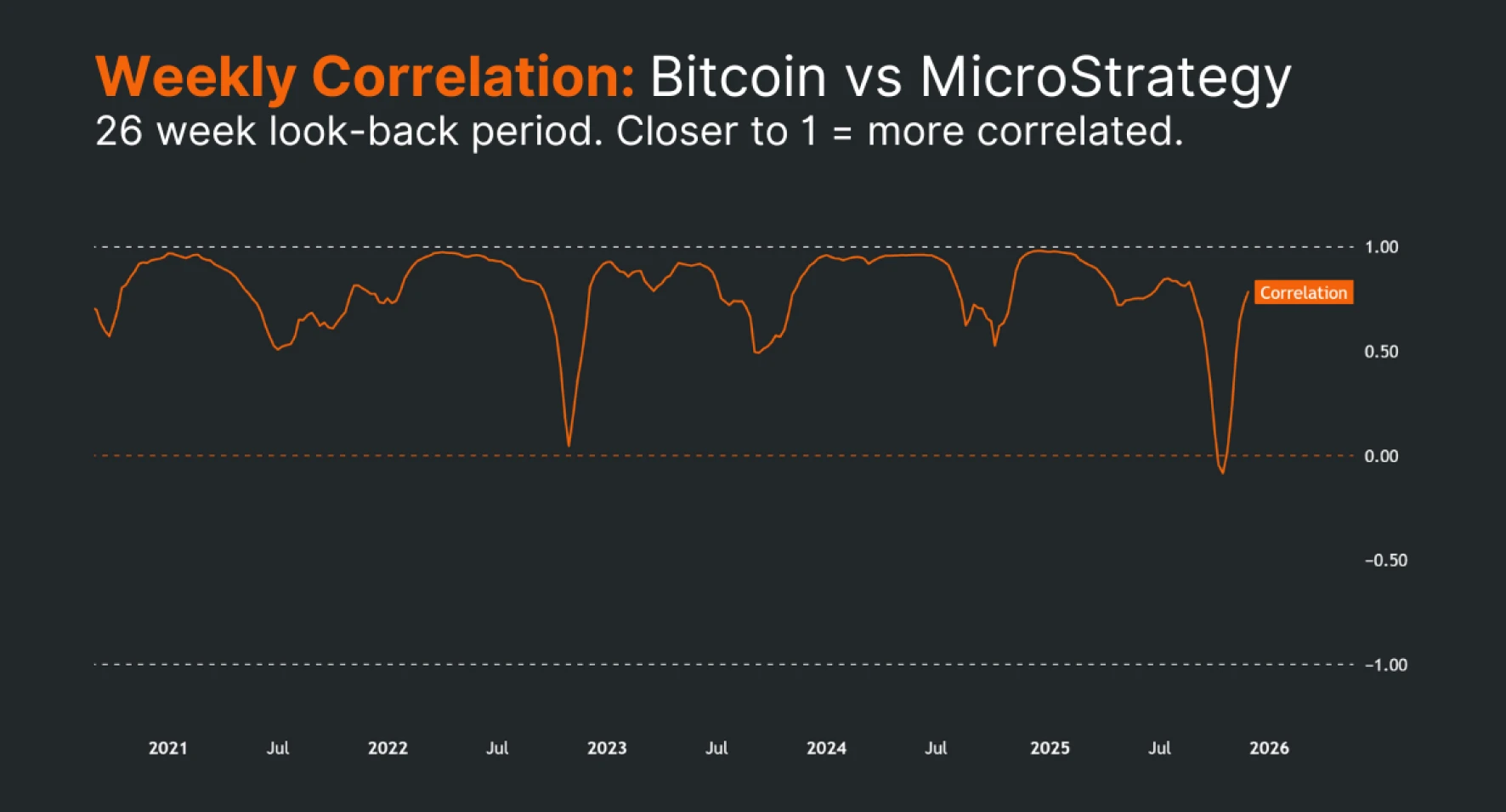

The chart below shows the weekly “rolling correlation” between Bitcoin and MicroStrategy. Put simply, it tracks how closely the two investments move week to week (over the past 26 weeks). The closer the correlation gets to positive 1, the more Bitcoin and MicroStrategy move together.

TradingView | As of 5 December, 2025

Notice that the correlation dropped below zero in October of this year. That’s the lowest reading since Michael Saylor first started buying Bitcoin for the company’s treasury in 2020. At that point, there was “no statistical relationship” between the weekly returns of the two investments. In other words, each asset did its own thing – and MicroStrategy didn’t behave like leveraged Bitcoin exposure during that time.

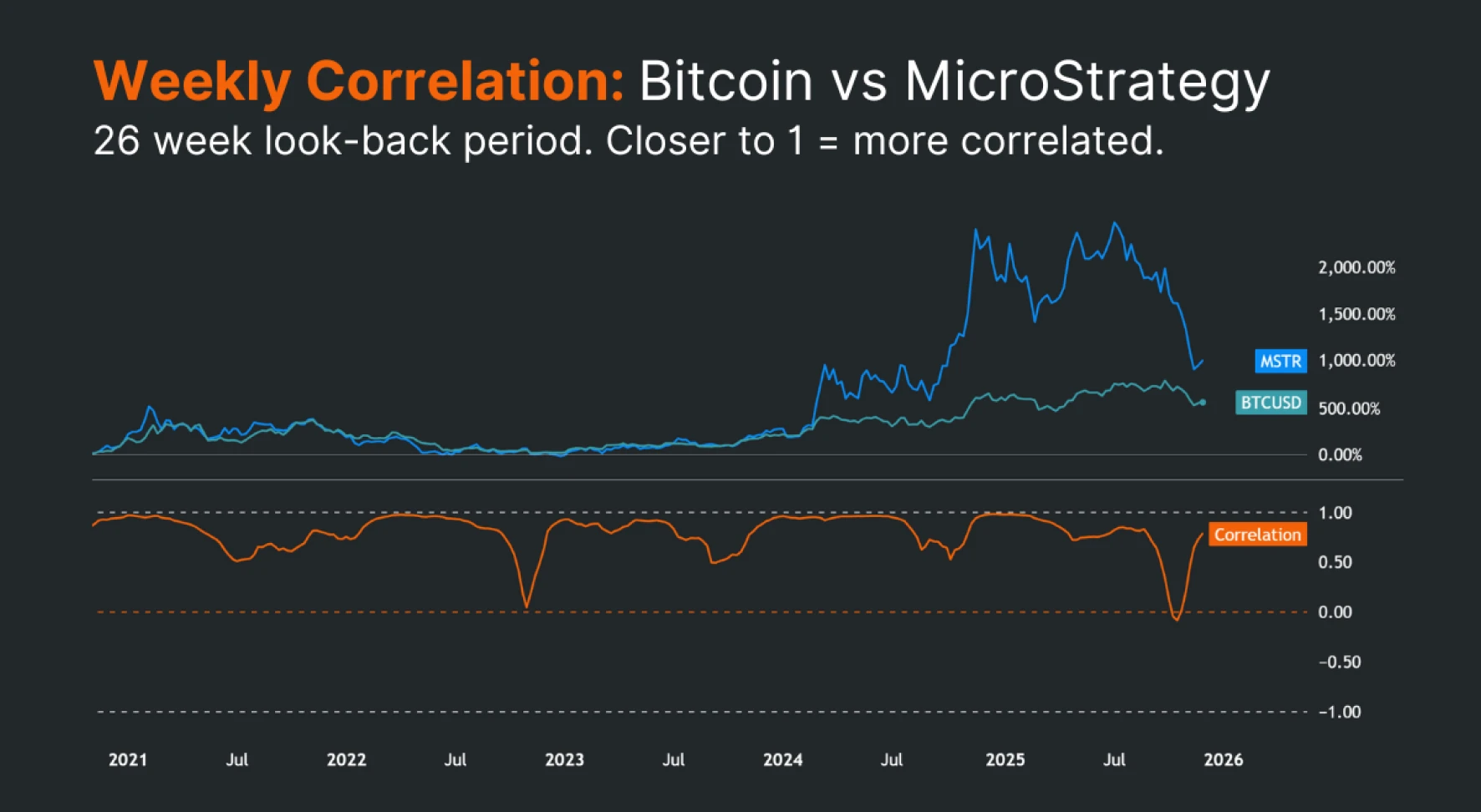

The next chart adds in the price moves of Bitcoin (teal) and MicroStrategy (blue). MicroStrategy started dropping over the summer on company-specific news, while Bitcoin traded sideways. One concern for MicroStrategy investors was potential share dilution. The company had been issuing new shares and preferred stock to fund more Bitcoin purchases. That meant existing shareholders could end up owning a smaller slice of the business.

Meanwhile, Bitcoin only started its drop in October. And when Bitcoin finally moved lower, both assets traded down together, as the market value of Microstrategy’s Bitcoin holdings became more of a concern. That’s when the correlation started climbing again.

TradingView | As of 5 December, 2025

Different ways investors gain exposure to Bitcoin’s moves

MicroStrategy’s share price includes both Bitcoin exposure and company-specific factors. Sure, it can sometimes behave like a leveraged version of Bitcoin – but only when company news isn’t driving the move.

Leverage Shares offers 3X daily long and short Bitcoin exchange-traded products. These products aim to magnify Bitcoin’s daily performance directly. They move with Bitcoin’s daily change rather than the mix of drivers behind a public company.

Key takeaways

MicroStrategy and Bitcoin often move together, but not always

The 26-week “rolling correlation” fell to its lowest level since 2020

Leveraged Bitcoin ETPs move with Bitcoin’s daily performance, without company-specific drivers