Ethereum fell roughly 11% in 2025, despite rising ETF inflows. Some investors now question whether the network still captures enough value to justify long-term exposure. This article explains the investment case for Ethereum in 2026.

What held Ethereum back in 2025?

Ethereum’s 2025 performance disappointed for a few reasons:

First, Ethereum spot ETFs never drove prices higher. According to data from The Block, spot Ethereum ETFs held roughly 3.5 million ether (ETH) between them at the start of 2025. But by year-end, they held 11.8 million ETH ($15.8 billion worth). The ETFs started the year with about 3% of the total coin supply, and ended it with 10%. Selling pressure elsewhere offset those ETF inflows, and the ETH price finished the year lower.

Second, Ethereum earned less from its own activity. Most of its transactions now happen on Layer-2 networks like Base, Arbitrum, and Polygon. These blockchains move transactions off Ethereum’s blockchain (the Layer 1), then settle them back on Ethereum. That makes Ethereum cheaper and faster to use, but it also means fewer fees flow directly to Ethereum itself.

Third, the market might be uneasy about ETH treasury company concentration risk. A handful of listed firms have raised money to buy and hold large amounts of ETH on their balance sheets. But one stands out above the rest: Tom Lee’s Bitmine Immersion Technologies. The company now holds 4 million ETH – over 3% of the total supply. That’s a lot of concentration risk if things go wrong for Bitmine.

Fourth, bitcoin had a down year. Bitcoin tends to lead the crypto market – its 6% drop in 2025 didn’t help the ETH price.

The investment case for Ethereum in 2026

A few things may support ETH this year:

First, Ethereum is the blockchain for tokenisation. Big financial institutions moving assets onchain have consistently chosen Ethereum. BlackRock’s BUIDL fund runs on Ethereum. Franklin Templeton and Fidelity have also tested tokenised funds on the network. These funds aren’t chasing speed or low fees of newer blockchains. They care about security, settlement, and reliability.

The same logic shows up in decentralized finance (DeFi). According to DeFiLlama, Ethereum holds $72 billion of the Total Value Locked in DeFi smart contracts – just under 60% of the market. If tokenisation gains traction, Ethereum could dominate that too.

Second, the SEC may approve staking for spot Ethereum ETFs. Spot Ethereum ETFs currently hold ETH without staking it for yield. Essentially, the US Securities and Exchange Commission (SEC) felt that staking could turn a passive ETF into something more active – so they never approved it for the initial launches.

But in December, BlackRock filed for a staked Ethereum ETF. The odds of approval could be reasonable, given the SEC’s new chair, Chair Paul Atkins, is friendlier to crypto. BlackRock also has a near-perfect ETF filing success rate. If the SEC approves staked Ethereum ETFs this year – or if the market prices it in beforehand – it could support demand for ETH.

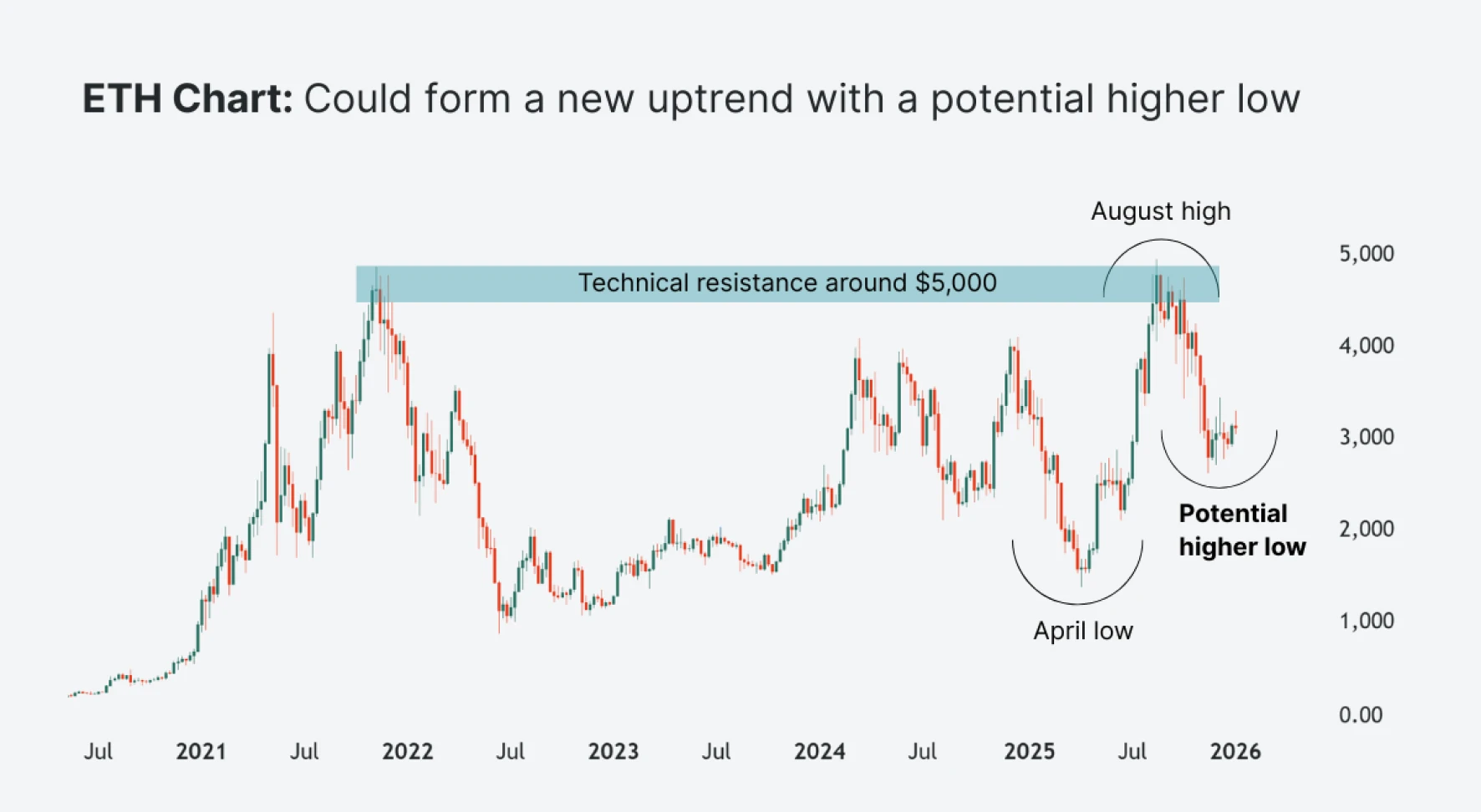

Third, ETH could form a new uptrend with a potential higher low. As the chart below shows, ETH had a severe drop (66%) to its April 2025 low. That decimated its prior uptrend of higher highs and higher lows. But from April to August, ETH rallied over 200% to a new all-time high of just under $5,000. Since then it’s pulled back, and is now seeing some buying pressure around $3,000. If this turns into a higher low, it could put ETH back in an uptrend.

Source: TradingView | As of January 8, 2026

Source: TradingView | As of January 8, 2026

Leverage Shares currently offers 3X long and short Ethereum ETPs.

Key takeaways

Ethereum underperformed in 2025, despite rising ETF inflows. Layer-2 fee capture, company treasury risks, and a down year for bitcoin held the ETH price down.

Tokenization is an area where Ethereum could benefit, as large institutions use it for secure onchain settlement.

If Ethereum ETFs are allowed to stake, ETH could do better in 2026. A higher low near current price levels could potentially shape a new uptrend.