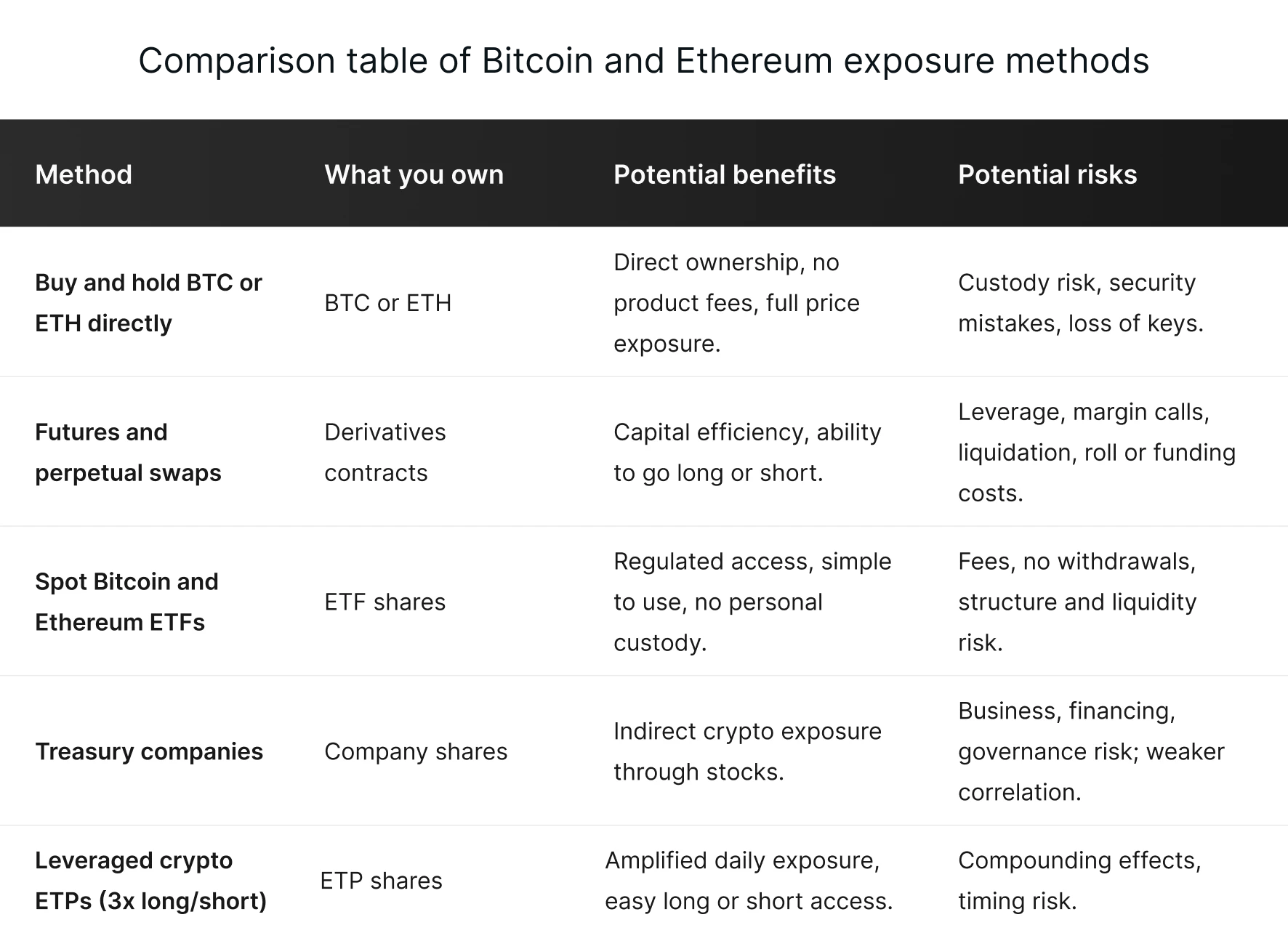

Bitcoin and Ethereum are the two biggest digital assets by market size. They’re also the most institutionalized, with a number of ways for investors to get exposure. Some methods give you direct ownership of Bitcoin (BTC) or Ethereum (ETH). Others offer indirect exposure, like exchange-traded funds and products, derivatives, and public companies.

In this guide, we’ll cover five ways investors can get exposure to Bitcoin and Ethereum. We’ll also weigh up their potential risks and benefits.

1. Buy and hold BTC or ETH directly

Direct ownership means you buy actual Bitcoin or Ethereum in the crypto market. Most investors do this through a crypto exchange. Some also buy through peer-to-peer or decentralised platforms, where trades settle directly between users on the blockchain.

You have two broad storage choices after you buy.

First, you can keep Bitcoin or Ethereum on a crypto exchange. That's technically the easiest way to directly hold digital assets, since the exchange handles the security and custody. But many crypto exchanges aren’t properly regulated. And if the exchange goes bankrupt or has a security breach, you may not always have access to your coins.

Second, you can hold assets in a private crypto wallet. These serve as interfaces between the blockchain and the user, with no central middleman to manage the platform. Hot wallets connect to the internet and make spending easier, while cold wallets store private keys offline and reduce online attack risk.

Personal wallets shift control back to you, but also the security risk. That could be a problem for inexperienced crypto users. You’ll need to secure private keys and manage seedphrase backup codes. And there’s no company helpline to call if you get hacked or scammed.

2. Bitcoin or Ethereum futures and perpetual swaps

Futures give you exposure to Bitcoin or Ethereum without owning the asset itself. Instead of buying the coins, you trade contracts whose value moves with their price. Traders often use futures to take larger positions with less capital, using leverage. That comes with the risk of margin calls and liquidation risk.

Perpetual swaps or “perps” are offered by many crypto exchanges. Unlike traditional futures, they don’t expire. Instead, they use a funding rate mechanism to keep the contract price in line with the actual spot price. When demand for long (buy) contracts rises, long positions typically pay funding fees to short positions. When demand for short contracts is stronger, shorts pay longs. These fees incentivize market makers to buy or sell perpetual swaps, so that the contracts track spot prices more closely. Over longer time frames, funding payments can add up and reduce returns.

Dated futures contracts, like those on the Chicago Mercantile Exchange (CME), work differently. These contracts have fixed expiry dates. To maintain exposure, traders must roll positions forward as contracts expire, which can create additional costs and complexity. CME futures trade in a regulated market, but they still involve leverage risks.

3. Spot Bitcoin and Ethereum ETFs

Spot exchange-traded funds provide exposure through traditional brokerage accounts. The fund holds Bitcoin or Ethereum on behalf of investors. And you can buy ETF shares on stock exchanges, just like regular stocks.

Spot ETFs remove the need for personal crypto custody or storage. The fund uses regulated custody and operational processes, which can reduce user error and security mistakes. That also makes access simpler for investors who already use brokerage platforms.

Spot ETFs often track spot prices closely, but they aren’t the same as holding the asset directly. You can’t trade 24/7, don’t control private keys, can’t withdraw crypto from the ETF, and pay a management fee.

ETFs can suit investors who want regulated access and operational simplicity. They can also fit portfolio frameworks that restrict direct crypto ownership. But they still carry structure risk. You rely on the fund, its custody solution, and market liquidity.

4. Bitcoin and Ethereum treasury companies

Some public companies hold Bitcoin or Ethereum on their balance sheets. Investors can buy shares in those companies to get indirect crypto exposure. These companies typically raise debt or issue shares to buy more crypto. This creates an indirect form of crypto leverage: it can amplify gains when prices rise, and magnify losses when prices fall.

MicroStrategy is the biggest Bitcoin treasury company, while BitMine Immersion Technologies holds the most ETH. The details differ by firm, but the mechanism is generally the same.

Keep in mind that these stocks aren’t pure crypto exposure. The market prices the company, not just the coins it holds. That adds business, financing, and governance risk.

5. Leveraged crypto ETPs (long and short)

Leverage Shares currently offers 3X long and short Bitcoin and Ethereum ETPs in Europe. These exchange-traded products provide amplified exposure to daily crypto price moves and trade on regulated stock exchanges. They don’t require crypto wallets, private keys, or margin accounts.

Traders typically use leveraged crypto ETPs for short-term trading or hedging, rather than long-term investing. That’s because holding the ETPs for longer periods can lead to compounding risk – when leveraged returns drift from their stated leverage factor.

See our Leveraged Crypto ETPs Explained guide to learn more.

Key takeaways

There are multiple ways for investors to get Bitcoin and Ethereum exposure. Each has different trade-offs between control, simplicity, and risk.

Indirect routes like ETFs, treasury companies, and ETPs offer convenience, but they aren’t the same as owning crypto directly.

Leveraged crypto products can amplify short-term moves, but they can also increase losses.