Short Bitcoin and Ethereum ETPs give investors a way to potentially benefit from falling crypto prices, without borrowing assets or trading derivatives directly. If used correctly, they can also help manage risk around short-term market events. Because short ETPs use leverage and reset daily, investors typically use them for tactical trades – not long-term positions.

Here are three reasons some investors might use short crypto ETPs.

Reason 1: Downside crypto price speculation

An investor might expect bitcoin (BTC) or ether (ETH) to fall over a short period, like a few days or a single trading session. A short crypto ETP allows them to express that view directly through a listed exchange-traded product.

A 3X short Bitcoin or Ethereum ETP aims to deliver three times the daily inverse return of the underlying asset, before fees. So if bitcoin falls 2% in one day, the ETP aims to rise about 6%. If bitcoin rises 2%, the ETP aims to fall about 6%.

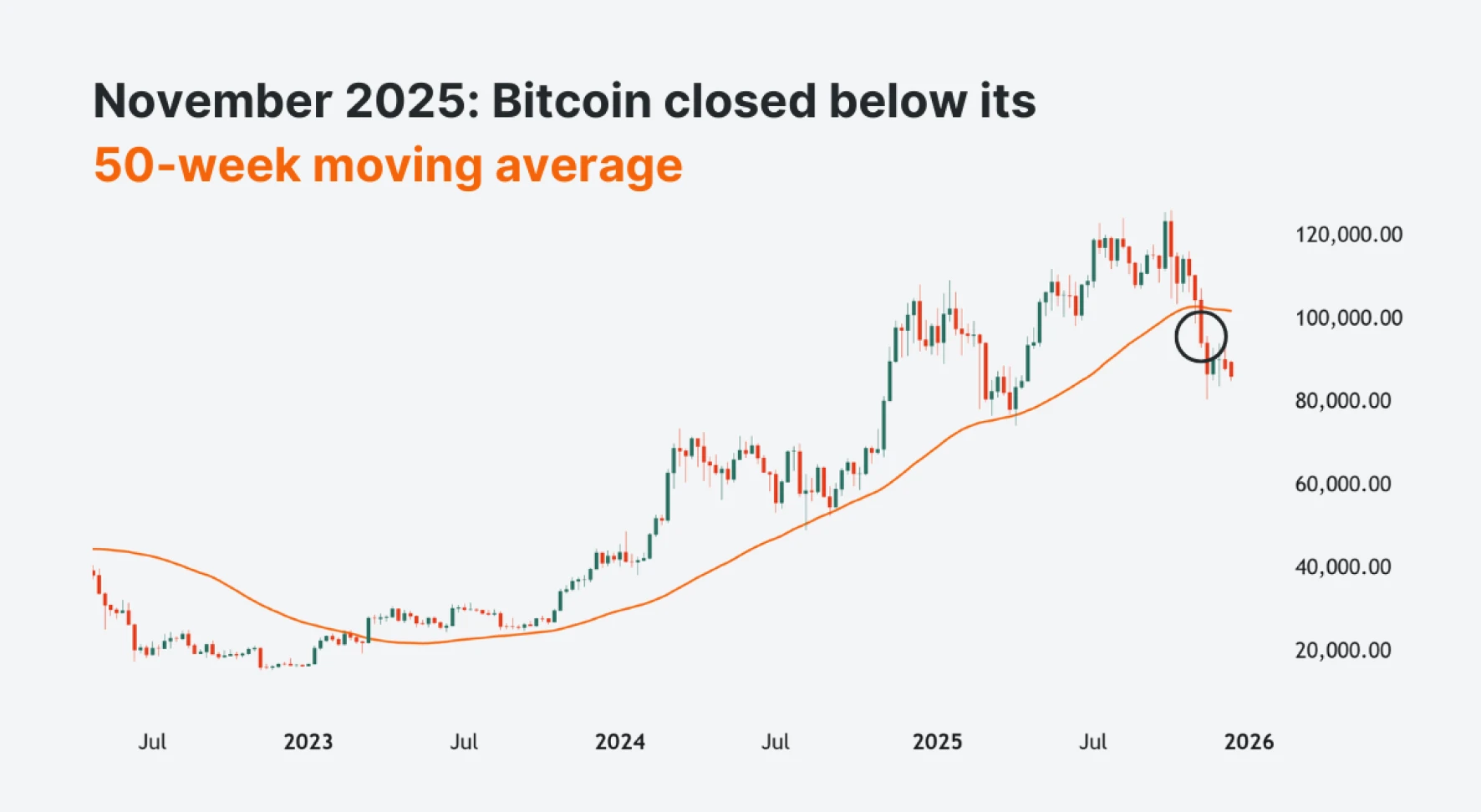

For example, in November, bitcoin closed the week below its 50-week moving average for the first time since early 2023. At that point, a momentum trader may have been expecting more short-term downside. They may have used a 3X short Bitcoin ETP to express that short-term view. Since the ETP uses leverage, the trader would also need to manage their position size and holding period accordingly.

Source: TradingView | As of 16 December, 2025

Short leveraged ETPs reset their exposure every trading day – for example, back to minus 3X. That reset means returns depend on the daily price path, not just the overall direction. Holding short crypto ETPs for longer periods could introduce compounding risk – where returns can drift from their stated multiple over time.

Reason 2: Short-term hedging

Hedging means reducing risk on an existing position, not eliminating it completely. Investors might hedge when they expect higher volatility over a defined time window.

Some investors hold spot bitcoin or ether for long-term exposure. Around major events, like a Fed interest rate decision or key inflation data, they may want temporary protection without selling their holdings.

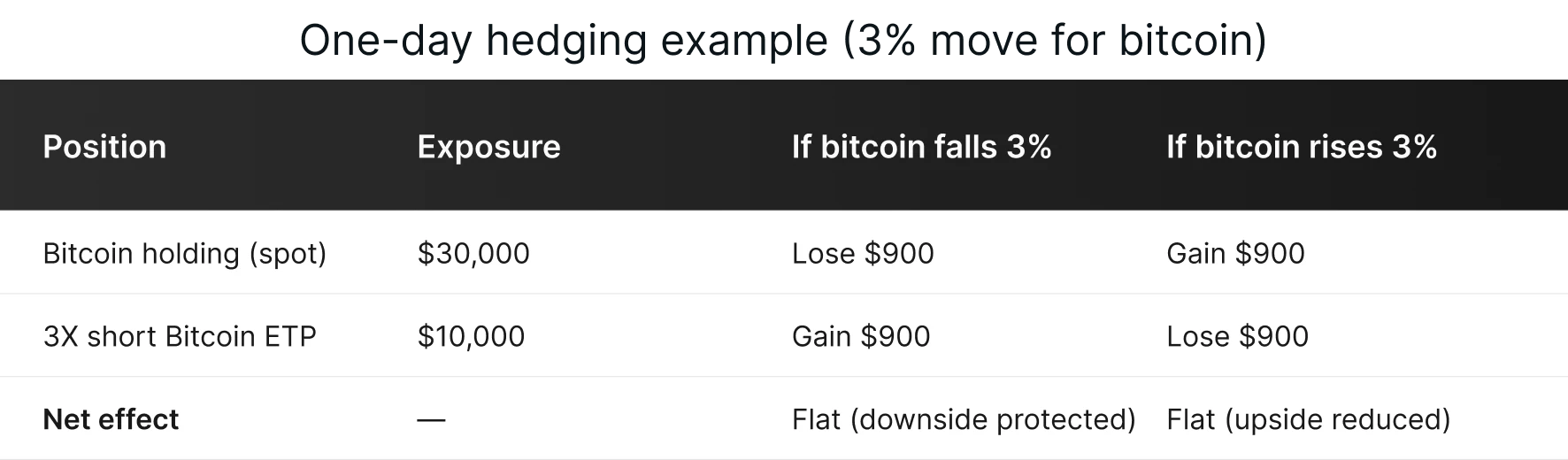

For example, an investor owns $30,000 worth of spot bitcoin. Ahead of a Fed announcement, they expect higher volatility for the next trading day. To hedge part of that risk, they buy $10,000 of a 3X short Bitcoin ETP for one trading session.

If bitcoin falls 3% that day, the spot position loses about $900. The short ETP may gain around 9% (roughly $900) to offset that. But if bitcoin rises 3% instead, the short ETP loses about 9% – offsetting the $900 spot gain. That’s the trade-off of hedging with a short position: sacrificing some potential upside for downside protection.

Illustrative example. Figures are hypothetical and for education only

Reason 3: Short-term “relative value” trades

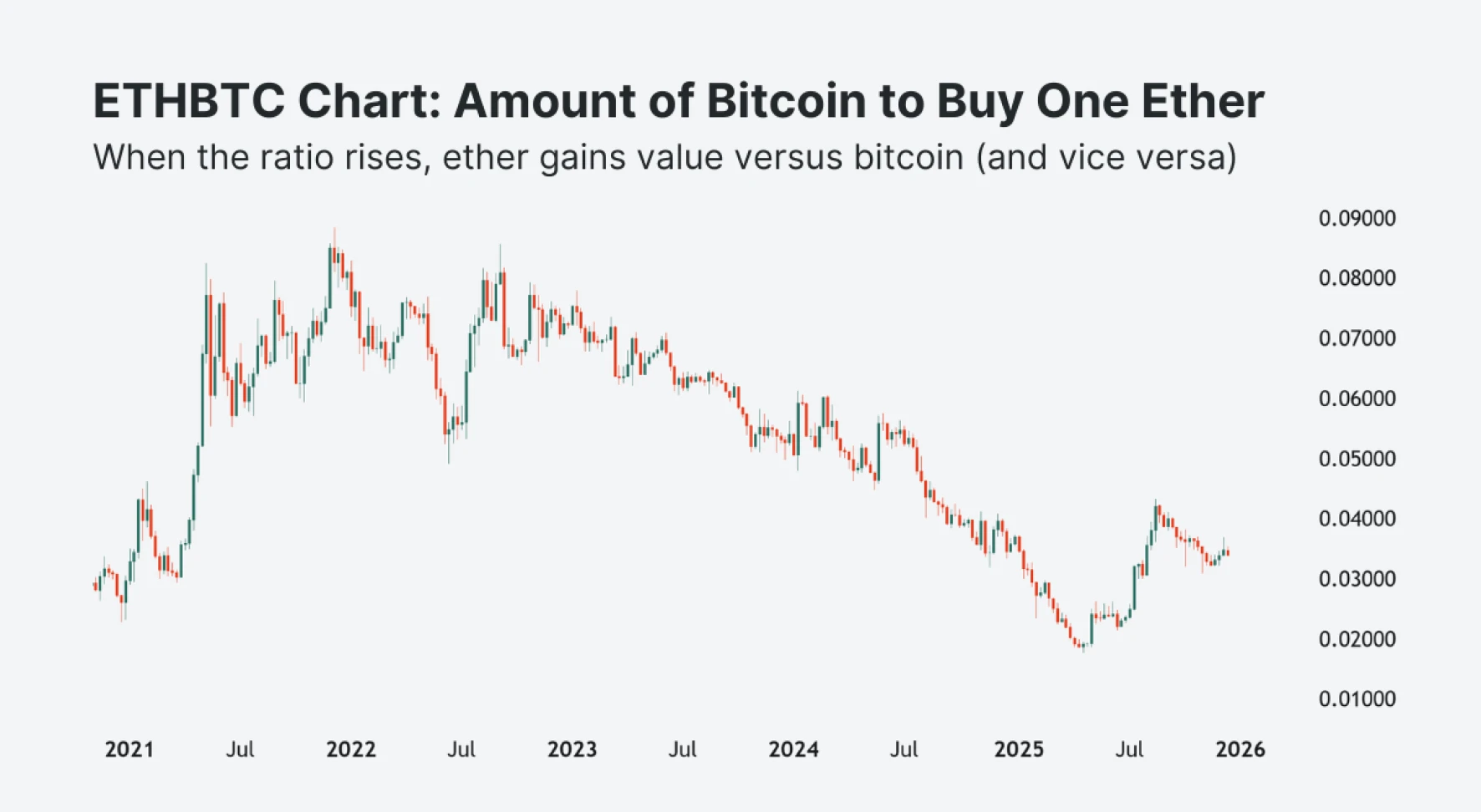

Some investors trade the relative performance between bitcoin and ether – rather than their absolute price direction. They often focus on the ETH/BTC ratio to identify short-term opportunities. When the ETH/BTC ratio rises, ether gains value relative to bitcoin (and vice versa).

Source: TradingView | As of 16 December, 2025

Let's say an investor thinks ether will outperform bitcoin over the next day. To express that view, they may buy a long Ethereum ETP and a short Bitcoin ETP for the same session. If ether performs better than bitcoin, the difference between the two positions may generate gains. But if ether underperforms, the relative value trade would make a loss.

Crypto relative value trades rely on timing, position size, and active monitoring. Because both ETPs reset daily, results can change quickly if the market turns.

Leverage Shares currently offers 3X long and short crypto ETPs for Bitcoin and Ethereum.

Key takeaways

Investors use short Bitcoin and Ethereum ETPs to express short-term bearish views on the crypto market.

Short crypto ETPs may also hedge existing spot holdings, sacrificing upside potential for temporary downside protection.

Some investors may use long and short Bitcoin and Ethereum ETPs together. They focus on short-term moves in the ETH/BTC ratio.